ES

There is some controversy right now as to whether the selling this last week really does mark the onset of a major correction or is merely a blip in the steady onwards and upwards What's significant to me is the break of the lower trendline of a nicely delineated channel that stretches back six months. This tells me that if we haven't seen the start of a significant correction, then we quite likely are in the early stages of a topping formation. In either case any move up should be limited and any move down should have much greater potential. If we close firmly below that lower channel line then I believe the rout will be on - we did break it but didn't close below it.

If the bullish case is correct and we resume the steady rise, then we are most likely looking at an extended Intermediate W3 (purple). Intermediate W3 started at the low of Aug 31. If it is extending then Minor W1 (red) will be marked at the top of Nov 9, with Minor W2 being the November correction, Minor W3 at the high of Feb 18 and Minor W4 in progress or complete at Thursday's lows.

If the selling this last week is, in fact, the start of a significant correction then the pattern in the ES is a little problematical. This is because there was very little alternation in the corrections to the down move as it unfolded, so to get a proper Elliott count wave 1 is counted as taking up the bulk of the travel of the drop. A little awkward, but it's important to note that this was not the case on the SPX or some of the other cash indexes. However, this is favorable to the bullish case as the sell off is much more easily counted as a double or triple zig zag.

From a bearish standpoint, the rally off the Thursday lows is approaching the .618 retrace of the down thrust and appears to be in the "c" wave of an irregular flat, so if the ES is to resume the selloff it should happen very early in the week. ES 1325 - 1335 should turn the market back down.

GOLD

The preferred count in gold is that it is in a Minor W4 (red). Since Minor W2 was a simple zig zag then by rule of alternation Minor W4 needs to be a flat or triangle or some type of complex formation. Since we are currently approaching the Minor W3 high of 1424 then a flat looks to be the best probability.

Gold - daily

In Minor W4, Minute W "a" is marked as done at the low of 1309 on Jan 27 with Minute W "b" in progress. Within Minute W "b" Micro waves "a" & "b" (black) are done with Micro W "c" nearly complete. The area of 1425 to 1435 has proved to be strong resistance three times in recent months, so there's a fair chance that gold will roll over in that area.

Gold - hourly

There is a very viable alternate in gold, and that is that Minor W4 was complete at the 1309 low of Jan 27 and that Minor W5 has been in progress since then. This is quite plausible given recent events in North Africa and the Middle East and the fact that gold is the "safe haven" choice. It would also dovetail nicely with a resumption in selling in the ES being driven by developments in the news.

Gold - daily - alternate count

Sunday, February 27, 2011

Wednesday, February 23, 2011

Wednesday 2/23/11 wrap up

ES

Today the ES bounced right off the lower trendline of a channel dating back to the late August lows. The hourly pattern looks very impulsive, so chances are very good that it will break below that channel in the near future. Also, five waves can be counted as complete up from the lows of last July, so for now I'm labeling the bull sequence from that low as complete. If that is correct, we should eventually move down to the area of the Intermediate W4 (purple) low in the ES 1175 - 1200 area over the coming weeks. Interestingly, ES 1172 marks a 50% retrace of the entire move up from last July.

EUR

Prices in the EUR have been quite choppy since the low of Feb 14. At present it looks like an expanding diagonal. If so, a diagonal always precedes a change in trend, so the EUR should roll over when it's concluded. From a labeling standpoint the best interpretation at this point is that the diagonal is the C wave of an expanded flat Minute W2. Minute W1 is labeled as ending at the low of Feb 4. The problem with this is that Minute W1 only lasted 3 days, while Minute W2 has taken 13 days to this point - not very proportional. This count gets invalidated if the EUR prints above the high of 1.3856 that marked the start of Minute W1.

EUR - hourly

EUR - daily

There is an intriguing possibility here. From a longer term point of view it could be that the EUR is putting in a triangle type Major Wave "b" (blue) since the Major Wave "a" low of last June. In that possibility we are in the third (c) leg of that pattern, and would see several more months of essentially sideways action before rolling over into Major Wave "c" down.

EUR - daily - triangle Wave B alternate

Today the ES bounced right off the lower trendline of a channel dating back to the late August lows. The hourly pattern looks very impulsive, so chances are very good that it will break below that channel in the near future. Also, five waves can be counted as complete up from the lows of last July, so for now I'm labeling the bull sequence from that low as complete. If that is correct, we should eventually move down to the area of the Intermediate W4 (purple) low in the ES 1175 - 1200 area over the coming weeks. Interestingly, ES 1172 marks a 50% retrace of the entire move up from last July.

EUR

Prices in the EUR have been quite choppy since the low of Feb 14. At present it looks like an expanding diagonal. If so, a diagonal always precedes a change in trend, so the EUR should roll over when it's concluded. From a labeling standpoint the best interpretation at this point is that the diagonal is the C wave of an expanded flat Minute W2. Minute W1 is labeled as ending at the low of Feb 4. The problem with this is that Minute W1 only lasted 3 days, while Minute W2 has taken 13 days to this point - not very proportional. This count gets invalidated if the EUR prints above the high of 1.3856 that marked the start of Minute W1.

EUR - hourly

EUR - daily

There is an intriguing possibility here. From a longer term point of view it could be that the EUR is putting in a triangle type Major Wave "b" (blue) since the Major Wave "a" low of last June. In that possibility we are in the third (c) leg of that pattern, and would see several more months of essentially sideways action before rolling over into Major Wave "c" down.

EUR - daily - triangle Wave B alternate

Tuesday, February 22, 2011

Tuesday 2/22/11 wrap up

SI (silver)

Silver has been in an accelerating bull market since lows in the fall of 2008. Currently it looks to be in Minor Wave 5 (red) of Intermediate Wave 3 (purple) of Major Wave 3 (blue) of that bull market, so there certainly appears to be a lot more upside potential over the coming months.

SI - daily

Minor W5 looks to be only partially complete. Since the Minor W4 low on Jan 27, a Minute W1 & W2 (green) can be counted, with Minute W3 in progress. Minute W3 is extending, with Micro Waves 1 through 3 (black) done and Micro W4 in progress. If this count is correct, there should be a continued strong upsurge for a month or two yet. There are alternate counts here which are less bullish, but the surge over the last week supports the more bullish scenario presented below.

Silver - hourly

Silver has been in an accelerating bull market since lows in the fall of 2008. Currently it looks to be in Minor Wave 5 (red) of Intermediate Wave 3 (purple) of Major Wave 3 (blue) of that bull market, so there certainly appears to be a lot more upside potential over the coming months.

SI - daily

Minor W5 looks to be only partially complete. Since the Minor W4 low on Jan 27, a Minute W1 & W2 (green) can be counted, with Minute W3 in progress. Minute W3 is extending, with Micro Waves 1 through 3 (black) done and Micro W4 in progress. If this count is correct, there should be a continued strong upsurge for a month or two yet. There are alternate counts here which are less bullish, but the surge over the last week supports the more bullish scenario presented below.

Silver - hourly

Monday, February 21, 2011

Monday 2/21/11 update

ES

After hours of intense study and analysis, I've finally identified what's going on in equities: it's a bull market.

Just kidding.

Hard dump in the ES in this morning's abbreviated session, possibly we've seen the termination of Minor W5 (red) of Intermediate W5 (purple) of the forever rally that started last July. With the continued unrest in the Mideast possibly we have the trigger for a major correction.

ES - hourly

But, as usual, there are alternates. The most likely alternate is that Intermediate W5 is extending with only Minor W1 & W2 complete and Minor W3 not even half done. This would call for a lot more upside before any sort of breather. As relentless as this market has been, this alternate is quite possible.

ES - hourly - alternate count

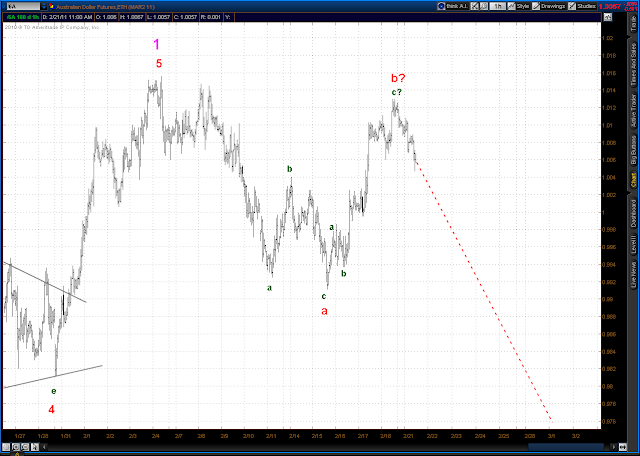

AUD/US$ (futures)

Long Term the AUD has been in a bull market since lows in Oct 2008. From those lows it rallied into a Major Wave "A" top in early 2010, then dropped to a Major Wave "B" bottom in May, 2010 and has been in a Major Wave "C" rally since that time.

AUD - daily

At this point there are two main alternates for the AUD, the first is as shown above. In it the AUD has just completed a Minor W4 triangle formation that commenced at the high of early Nov. It is thus in Minor W5 on the way to an Intermediate W1 top. Based on some fibonnaci analysis it appears that a likely target for that top is the 1.07 area.

AUD daily - 1st alternate

Aud hourly - 1st alternate

The second alternate shows Intermediate W1 complete at the high of Feb 4 with Intemediate W2 in progress.

AUD daily - 2nd alternate

Since that Feb 4 top the AUD has put in the first leg down of Intermediate W2, that leg is labeled Minor Wave "a" (red) in the below chart. Minor Wave "b" is in progress since then, and quite possibly complete at last Friday's high. If so we should continue down from here.

AUD hourly - 2nd alternate

So how can we tell which alternate is the correct one? If the AUD rallies strongly up through the high of 1.0168 established in late Dec then alternate 1 is most likely correct. However, if the AUD drops below the top of the first leg up in the current rally from Feb 15 then alternate 2 is probably correct. That short term top was at .9978. So a break above 1.0168 or below .9978 should resolve the question.

After hours of intense study and analysis, I've finally identified what's going on in equities: it's a bull market.

Just kidding.

Hard dump in the ES in this morning's abbreviated session, possibly we've seen the termination of Minor W5 (red) of Intermediate W5 (purple) of the forever rally that started last July. With the continued unrest in the Mideast possibly we have the trigger for a major correction.

ES - hourly

But, as usual, there are alternates. The most likely alternate is that Intermediate W5 is extending with only Minor W1 & W2 complete and Minor W3 not even half done. This would call for a lot more upside before any sort of breather. As relentless as this market has been, this alternate is quite possible.

ES - hourly - alternate count

AUD/US$ (futures)

Long Term the AUD has been in a bull market since lows in Oct 2008. From those lows it rallied into a Major Wave "A" top in early 2010, then dropped to a Major Wave "B" bottom in May, 2010 and has been in a Major Wave "C" rally since that time.

AUD - daily

At this point there are two main alternates for the AUD, the first is as shown above. In it the AUD has just completed a Minor W4 triangle formation that commenced at the high of early Nov. It is thus in Minor W5 on the way to an Intermediate W1 top. Based on some fibonnaci analysis it appears that a likely target for that top is the 1.07 area.

AUD daily - 1st alternate

Aud hourly - 1st alternate

The second alternate shows Intermediate W1 complete at the high of Feb 4 with Intemediate W2 in progress.

AUD daily - 2nd alternate

Since that Feb 4 top the AUD has put in the first leg down of Intermediate W2, that leg is labeled Minor Wave "a" (red) in the below chart. Minor Wave "b" is in progress since then, and quite possibly complete at last Friday's high. If so we should continue down from here.

AUD hourly - 2nd alternate

So how can we tell which alternate is the correct one? If the AUD rallies strongly up through the high of 1.0168 established in late Dec then alternate 1 is most likely correct. However, if the AUD drops below the top of the first leg up in the current rally from Feb 15 then alternate 2 is probably correct. That short term top was at .9978. So a break above 1.0168 or below .9978 should resolve the question.

Sunday, February 20, 2011

Weekend Update 2/20/11

This week was an object lesson in that oldest of trading adages: THE TREND IS YOUR FRIEND and it's corollary DON'T FIGHT THE TREND. I came into the week bearish on the EUR/US$, AUD/US$, and SI (silver) with short positions on all three. My Elliott wave analysis showed the EUR and AUD in downtrends with more selling to come and SI at or near a top (see my Wednesday post). By the end of the week I was long all three with very solid profits ($12,000+ per contract on SI - sorry couldn't resist bragging).

One of the most difficult things to learn in order to be a successful trader is to not get emotionally committed to one's analysis of a market. At least I found it to be difficult. But it's also one of the most important things to learn. A rare trader it is who doesn't have some opinion on what a particular market may do next, sometimes that opinion is based on gut feel, sometimes on an in depth analytical framework over which much labor is expended. Either way, it's difficult to not let the conclusions of that analysis cloud one's view of what a market is actually doing. But it's extremely important to learn not to do so. Markets are two ton elephants, they're going to do what they're going to do regardless of your opinion - so it's best to either get out of the way or (better yet) jump on for the ride if things aren't going the way you expected.

In my case I use Elliott Wave theory as a market analysis tool. But I don't use that analysis to decide which way to trade (i.e. long or short) nor to decide when to enter or exit. I use it primarily because it gives perspective, also as a means of deciding how large a position to take on a given trade, and finally because it's fun. But my primary trading tool is an approach I've developed that I call the Trendline/Oscillator system. I've written a basic explanation of the Trend/Osc system and posted it in the sidebar to the right, there is a lot more to it which I intend to elucidate at some future date when time permits. But the reason I mention it in this discussion is to highlight the basic goals of the system: 1) identify a trend in it's early stages and ride that trend for most of it's run, and 2) recognize and reverse positions if a trend has been identified incorrectly. It's not designed to catch absolute tops or bottoms, and I don't believe that is necessary - a lot of money can be made if one catches the middle 80% or so of a run.

Truthfully any individual could develop a successful approach of their own as long as they establish the goals used for the Trend/Osc system. The idea is to utilize an approach that allows you to go with the flow - and then adhere to that approach even if it means that any bias you bring to the equation is contradicting what the approach says you should do.

I had a lot of commitments this weekend which precluded me from doing any EW analysis on the markets I follow, I'll try to get caught up tomorrow and maybe post something tomorrow evening.

One of the most difficult things to learn in order to be a successful trader is to not get emotionally committed to one's analysis of a market. At least I found it to be difficult. But it's also one of the most important things to learn. A rare trader it is who doesn't have some opinion on what a particular market may do next, sometimes that opinion is based on gut feel, sometimes on an in depth analytical framework over which much labor is expended. Either way, it's difficult to not let the conclusions of that analysis cloud one's view of what a market is actually doing. But it's extremely important to learn not to do so. Markets are two ton elephants, they're going to do what they're going to do regardless of your opinion - so it's best to either get out of the way or (better yet) jump on for the ride if things aren't going the way you expected.

In my case I use Elliott Wave theory as a market analysis tool. But I don't use that analysis to decide which way to trade (i.e. long or short) nor to decide when to enter or exit. I use it primarily because it gives perspective, also as a means of deciding how large a position to take on a given trade, and finally because it's fun. But my primary trading tool is an approach I've developed that I call the Trendline/Oscillator system. I've written a basic explanation of the Trend/Osc system and posted it in the sidebar to the right, there is a lot more to it which I intend to elucidate at some future date when time permits. But the reason I mention it in this discussion is to highlight the basic goals of the system: 1) identify a trend in it's early stages and ride that trend for most of it's run, and 2) recognize and reverse positions if a trend has been identified incorrectly. It's not designed to catch absolute tops or bottoms, and I don't believe that is necessary - a lot of money can be made if one catches the middle 80% or so of a run.

Truthfully any individual could develop a successful approach of their own as long as they establish the goals used for the Trend/Osc system. The idea is to utilize an approach that allows you to go with the flow - and then adhere to that approach even if it means that any bias you bring to the equation is contradicting what the approach says you should do.

I had a lot of commitments this weekend which precluded me from doing any EW analysis on the markets I follow, I'll try to get caught up tomorrow and maybe post something tomorrow evening.

Wednesday, February 16, 2011

Wednesday 2/16/11 wrap up

AUD/US$ (futures)

The late afternoon rally today blew up my short term Elliott count for the AUD. I still believe the underlying trend is down. Right now it looks like we may be forming a flat correction from the low last Friday, with the "a" leg done at Monday's high and the "b" leg done at yesterday's low. The "c" leg is currently in progress and should be a 5 wave impulse. Today's PM rally looks like the 3rd wave of that move. Minimum target is Monday's high at 1.0040, with a .618 retrace of the preceding sell-off at 1.0062 as a possible limit.

AUD hourly

Got stopped out of a short AUD position during today's rally, went long AUD late in the day. I'm planning on dumping 1/2 of that position at 1.0040, and probably will tighten up the stop on the balance if that happens.

EUR/US$

The pattern in the EUR since Monday's low is definitely corrective looking. We've already hit the 50% retrace level of the preceding downstroke at 1.3582, if that doesn't mark the top the next target level is the .618 retrace at 1.3619.

Silver

We may be at or near the top of the rally in silver that started on Jan 27. Initial target was the Jan 3 high at 31.275. Silver hit a high for the current rally today at 30.97, which is pretty close. In addition, today's little rally could be labeled as the 5th wave to a move up that started on Feb 1 which would complete the "c" leg of the rally that started Jan 27.

The late afternoon rally today blew up my short term Elliott count for the AUD. I still believe the underlying trend is down. Right now it looks like we may be forming a flat correction from the low last Friday, with the "a" leg done at Monday's high and the "b" leg done at yesterday's low. The "c" leg is currently in progress and should be a 5 wave impulse. Today's PM rally looks like the 3rd wave of that move. Minimum target is Monday's high at 1.0040, with a .618 retrace of the preceding sell-off at 1.0062 as a possible limit.

AUD hourly

Got stopped out of a short AUD position during today's rally, went long AUD late in the day. I'm planning on dumping 1/2 of that position at 1.0040, and probably will tighten up the stop on the balance if that happens.

EUR/US$

The pattern in the EUR since Monday's low is definitely corrective looking. We've already hit the 50% retrace level of the preceding downstroke at 1.3582, if that doesn't mark the top the next target level is the .618 retrace at 1.3619.

Silver

We may be at or near the top of the rally in silver that started on Jan 27. Initial target was the Jan 3 high at 31.275. Silver hit a high for the current rally today at 30.97, which is pretty close. In addition, today's little rally could be labeled as the 5th wave to a move up that started on Feb 1 which would complete the "c" leg of the rally that started Jan 27.

Tuesday, February 15, 2011

Tuesday 2/15/11 wrap up

AUD/US$ (futures)

Long term a bull market in the AUD dating back to last May appears to have topped at the highs of Feb 4. If this is true the AUD should see a significant amount of selling in the next few months.

There are two legitimate possibilities in the EW count from the Feb 4 top, bearish and hyper-bearish. In the bearish view the AUD is in the 5th and thus final leg of the first move down from the Feb 4th top. In the hyper-bearish view, that move is extending and is currently in the 3rd of the 3rd of the 3rd wave of the series. Obviously, in the hyper-bear scenario the selling should accelerate almost immediately and the AUD has quite a bit to go before any significant correction. So we should know which is correct fairly quickly.

AUD - hourly - bearish

AUD - hourly - hyper-bearish

Long term a bull market in the AUD dating back to last May appears to have topped at the highs of Feb 4. If this is true the AUD should see a significant amount of selling in the next few months.

There are two legitimate possibilities in the EW count from the Feb 4 top, bearish and hyper-bearish. In the bearish view the AUD is in the 5th and thus final leg of the first move down from the Feb 4th top. In the hyper-bearish view, that move is extending and is currently in the 3rd of the 3rd of the 3rd wave of the series. Obviously, in the hyper-bear scenario the selling should accelerate almost immediately and the AUD has quite a bit to go before any significant correction. So we should know which is correct fairly quickly.

AUD - hourly - bearish

AUD - hourly - hyper-bearish

Monday, February 14, 2011

Monday 2/14/11 wrap up

As mentioned in the weekend update, the rally in SI from the Jan 27 low wasn't done last week. However, we are getting close to being able to count 5 waves up complete from the low of Feb 3. Target is still the high of Jan 3 at 31.275.

I reversed my short SI position from Friday to long SI very early this AM.

I reversed my short SI position from Friday to long SI very early this AM.

Saturday, February 12, 2011

Weekend Update 2/12/11

ES

Posted these charts on Thursday:

ES Daily

ES hourly

Friday's action brought a classic looking impulse wave up with waves 1 through 4 complete and wave 5 in progress.

ES hourly

ES 5 minute bars

The problem with the implication here (top very close by) is that next week is options expiration week, which has been reliably bullish in recent history. Never easy, is it?

SILVER

SI daily

After putting in a major long term low in October 2008 at 8.40/oz SI has been on a tear, especially in 2010. It has generated a Major Wave 1 - 2 (blue), Intermediate W 1 - 2 (purple) and Minor W 1 - 2 (red) since that time. All the 2nd waves have been zig zag formations. From the Minor W2 low in Feb 2010 to the high of Jan 3, 2011 five waves up can be counted as complete. If this is correct, Minor W3 is concluded and SI is now tracing out Minor W4. Since Minor W2 was a simple zig zag then Minor W4 needs to be a flat or triangle or some type of complex corrective formation to satisfy the Elliott rule of alternation. Which is why the January sell off has only been labeled Wave "a" of Minor W4. Also, Minor W2 took a little over two months to transpire, so it would be expected that Minor W4 would have similar duration.

SI daily - zoomed in

So far so good, but now it gets tricky. In the hourly chart below there is one five wave structure visible since the Minute W "a" (green) low of Jan 27. That impulse has been tentatively labeled Micro Wave "a" with a low of Feb 3 labeled Micro Wave "b". The pattern since that low looks incomplete, so there is likely more upside left before Micro Wave "c" and thus Minute Wave "b" is done. The tricky part is the question of what type of correction is being formed - a triangle, a flat or something else? Since the early Jan high was at 31.275, which is not far away, it seems a flat is the most likely with that Jan high as the target before any real serious selling ensues. And, of course, there is always the possibility that my longer term analysis and Elliott count is wrong and that the low of Jan 27 marks a low that will hold for quite a while - in other words, correction over and up, up and away.

SI hourly

Went (nervously) short SI late Friday based on a Trend/Osc sell signal, but given the above analysis I am prepared to reverse positions to long with little hesitation.

Posted these charts on Thursday:

ES Daily

ES hourly

Friday's action brought a classic looking impulse wave up with waves 1 through 4 complete and wave 5 in progress.

ES hourly

ES 5 minute bars

The problem with the implication here (top very close by) is that next week is options expiration week, which has been reliably bullish in recent history. Never easy, is it?

SILVER

SI daily

After putting in a major long term low in October 2008 at 8.40/oz SI has been on a tear, especially in 2010. It has generated a Major Wave 1 - 2 (blue), Intermediate W 1 - 2 (purple) and Minor W 1 - 2 (red) since that time. All the 2nd waves have been zig zag formations. From the Minor W2 low in Feb 2010 to the high of Jan 3, 2011 five waves up can be counted as complete. If this is correct, Minor W3 is concluded and SI is now tracing out Minor W4. Since Minor W2 was a simple zig zag then Minor W4 needs to be a flat or triangle or some type of complex corrective formation to satisfy the Elliott rule of alternation. Which is why the January sell off has only been labeled Wave "a" of Minor W4. Also, Minor W2 took a little over two months to transpire, so it would be expected that Minor W4 would have similar duration.

SI daily - zoomed in

So far so good, but now it gets tricky. In the hourly chart below there is one five wave structure visible since the Minute W "a" (green) low of Jan 27. That impulse has been tentatively labeled Micro Wave "a" with a low of Feb 3 labeled Micro Wave "b". The pattern since that low looks incomplete, so there is likely more upside left before Micro Wave "c" and thus Minute Wave "b" is done. The tricky part is the question of what type of correction is being formed - a triangle, a flat or something else? Since the early Jan high was at 31.275, which is not far away, it seems a flat is the most likely with that Jan high as the target before any real serious selling ensues. And, of course, there is always the possibility that my longer term analysis and Elliott count is wrong and that the low of Jan 27 marks a low that will hold for quite a while - in other words, correction over and up, up and away.

SI hourly

Went (nervously) short SI late Friday based on a Trend/Osc sell signal, but given the above analysis I am prepared to reverse positions to long with little hesitation.

Thursday, February 10, 2011

Thursday 2/10/11 wrap up

Current ES counts:

ES hourly

ES daily

EUR/US$

Been getting a good case of whiplash in my EUR trading since the beginning of the month, but when I back out and look at the Elliott count it appears fairly simple. Don't know what happened to my crystal ball, may need to invest in a de-fogger.

EUR hourly

EUR hourly - zoomed in - note the almost perfect .618 retrace of Minute W1 (green)

EUR daily

If these counts are correct, the EUR/US$ should accelerate down tomorrow.

ES hourly

ES daily

EUR/US$

Been getting a good case of whiplash in my EUR trading since the beginning of the month, but when I back out and look at the Elliott count it appears fairly simple. Don't know what happened to my crystal ball, may need to invest in a de-fogger.

EUR hourly

EUR hourly - zoomed in - note the almost perfect .618 retrace of Minute W1 (green)

EUR daily

If these counts are correct, the EUR/US$ should accelerate down tomorrow.

Tuesday, February 8, 2011

Tuesday 2/8/11 wrapup

ES

Are we there yet? Maybe.

AUD

--has been kicking me in the teeth lately. Put on a short position there on Friday, added to shorts yesterday with a tight stop and got taken out on added contracts overnight. Price pattern has been really odd the last few days. It will need to develop more before I can identify and apply Elliot labels to it with any confidence.

Are we there yet? Maybe.

AUD

--has been kicking me in the teeth lately. Put on a short position there on Friday, added to shorts yesterday with a tight stop and got taken out on added contracts overnight. Price pattern has been really odd the last few days. It will need to develop more before I can identify and apply Elliot labels to it with any confidence.

Friday, February 4, 2011

Weekend Update 2/4/11

ES moving ever higher. I'm reluctant to post this count as it shows the ES in the final Minor W5 (red) of Intermediate W5 of the bull market from last summer's lows, which has been proposed multiple times in the recent past and been wrong every time. It is what it is, and this is what it looks like at the moment. Target is still the ES 1325 area - not far away and easily achievable Monday or Tuesday next week.

Zooming in on the count since the low last Sunday night, we appear to be in the 5th wave of that rally as well.

The EUR/US$ threw a little head fake last Friday into Sunday night, but it does appear to have topped on Tuesday. Five waves up from the low of Jan 10 can be counted into Tuesday's high, and the action since then is clearly five waves down. The EUR topped at 1.3856, a little past the .618 retrace at 1.3776 but still in the vicinity. Interestingly Minute W5 (green) of the rally from Jan 10 is almost exactly half of Minute W1 (.0583 for Min W1 and .0292 for Min W5).

If this count is correct the top on Tuesday marks a significant intermediate term change of trend. It would mark the end of an Intermediate Wave "b" correction to a Major Wave "c" bear market that started at the high of Nov 4. We would thus be in Intermediate Wave "c" of that bear market.

First target for Major W "c" is the low of Major Wave "a" last June, which was EUR 1.1874. A 1.618 multiple of Intermediate Wave "a" subtracted from Tuesday's high lands at 1.1740, right in the vicinity of that Major Wave "a" low. So that's a reasonable starting expectation.

The AUD/US$ also appears to have put in a significant top at today's high.

If this count is correct, there are five waves up complete for the bull market that started last May and thus some serious selling ahead.

The action in these two currencies points to strength in the dollar. That strength was reflected in the DX which is showing a clear 5 wave pattern up from a low Tuesday night. If in fact there is a change in trend towards a stronger US$ it will provide bearish pressure to equities. This helps buttress the case for a top in the ES being nearby.

Zooming in on the count since the low last Sunday night, we appear to be in the 5th wave of that rally as well.

The EUR/US$ threw a little head fake last Friday into Sunday night, but it does appear to have topped on Tuesday. Five waves up from the low of Jan 10 can be counted into Tuesday's high, and the action since then is clearly five waves down. The EUR topped at 1.3856, a little past the .618 retrace at 1.3776 but still in the vicinity. Interestingly Minute W5 (green) of the rally from Jan 10 is almost exactly half of Minute W1 (.0583 for Min W1 and .0292 for Min W5).

If this count is correct the top on Tuesday marks a significant intermediate term change of trend. It would mark the end of an Intermediate Wave "b" correction to a Major Wave "c" bear market that started at the high of Nov 4. We would thus be in Intermediate Wave "c" of that bear market.

First target for Major W "c" is the low of Major Wave "a" last June, which was EUR 1.1874. A 1.618 multiple of Intermediate Wave "a" subtracted from Tuesday's high lands at 1.1740, right in the vicinity of that Major Wave "a" low. So that's a reasonable starting expectation.

The AUD/US$ also appears to have put in a significant top at today's high.

If this count is correct, there are five waves up complete for the bull market that started last May and thus some serious selling ahead.

The action in these two currencies points to strength in the dollar. That strength was reflected in the DX which is showing a clear 5 wave pattern up from a low Tuesday night. If in fact there is a change in trend towards a stronger US$ it will provide bearish pressure to equities. This helps buttress the case for a top in the ES being nearby.

Tuesday, February 1, 2011

Tuesday 2/1/11 wrap up

Turns out the alternate ES count mentioned in the weekend post was the correct one. The pattern from the high of Wed Jan 19 through Sunday night is most likely a Minor W4 (red) with Minor W5 of Intermediate W5 now in progress.

Minor W1 in early Dec ran 62.75 points and lasted 6 days. If we add 62.75 to Sunday's low at 1262.25 then Minor W5 would equal Minor W1 at ES 1325. Also, 6 days from Sunday night would be Monday Feb 7.

ES daily chart for perspective:

There is an alternate here that bears serious attention (and would upset all you perma bears). That alternate is that the entirety of the rally from the late Aug low is an extended Intermediate W3 (purple). Obviously that means the ES has quite a bit of upside yet before any serious correction to the bull market that started last July. There are reasons to give this idea credence. Economic reports continue to show improvement. Also, and probably more importantly, is mass psychology. With the Nov elections there was a break in the total Democratic hold on national power, very similar to what happened in 1994. Below is a chart of the SPX for the period from mid 1994 through mid 1996. Just sayin.........

Minor W1 in early Dec ran 62.75 points and lasted 6 days. If we add 62.75 to Sunday's low at 1262.25 then Minor W5 would equal Minor W1 at ES 1325. Also, 6 days from Sunday night would be Monday Feb 7.

ES daily chart for perspective:

There is an alternate here that bears serious attention (and would upset all you perma bears). That alternate is that the entirety of the rally from the late Aug low is an extended Intermediate W3 (purple). Obviously that means the ES has quite a bit of upside yet before any serious correction to the bull market that started last July. There are reasons to give this idea credence. Economic reports continue to show improvement. Also, and probably more importantly, is mass psychology. With the Nov elections there was a break in the total Democratic hold on national power, very similar to what happened in 1994. Below is a chart of the SPX for the period from mid 1994 through mid 1996. Just sayin.........

Subscribe to:

Posts (Atom)