In the ES on the short term, the pattern since the spike high on 9/17 @ 2011.75 into last Thursday's low at 1897.25 is an impulse:

The count may look a bit awkward, but it is supported by the patterns in the SPX and the NYA over the same time frame which are clearly 5 wave moves. As noted on the chart the bounce since Thursday's low may be all of the correction against that impulse or wave "a" of that correction. If the correction has more to come then a possible area for it's conclusion is the .618 retrace of the impulse at ES 1968. That level also happens to be the area where the 4th wave of the down impulse topped, which is a common retrace terminus for a correction.

Backing out to a longer view, it's very difficult to see how the action in the market since the ES 1831.00 crash low of Aug 24 into the Sep 17 spike high is anything but a corrective sequence. Lots of overlaps and choppiness, anything but an impulsive character which would mark the start of a bull move. So it is most probable that the 1831.00 low will be tested and likely exceeded in the coming weeks.

Sunday, September 27, 2015

Monday, September 21, 2015

Sunday, September 20, 2015

Sunday, 9/20/15 update

Let's start with the short term. The sell off that started Thursday has generated a 5 wave structure with the 5th wave close to completed (or complete):

The Equity Oscillator and Tick Analysis are down at the bottom of their ranges, so the technicals are in a position where a rally is made possible:

So the set up for a short term rally is in place. If the impulse off the Thursday high is not complete, ES 1939.50 and 1934.00 are levels to watch for a turn. One final note: in the above count wave 3 is shorter than wave 1, so wave 5 cannot exceed wave 3. Based on that observation, ES 1928.75 is the point at which waves 5 and 3 would be equal, so a continuation below that level will mean that something else is at play here - either the move is extending or it's forming something other than an impulse.

Backing out to a longer perspective, the ES has formed a double zig-zag from the Aug 24 crash low at 1831.00 into Thursday's spike high at 2011.75:

Elliott Wave rules allow for up to three zig-zags in a multiple zig-zag formation. So there is the possibility that the structure off the 1831.00 low is not complete. At this point that likelihood appears to have a low probability but it has to be recognized. The probability is low because as of Thursday the upward drift since the 1831.00 low has provided relief to the "oversold" conditions extant at that low. So the favored view is that the ES has concluded a bear market correction as of Thursday and more significant selling is on deck following a short term rally early next week.

The Equity Oscillator and Tick Analysis are down at the bottom of their ranges, so the technicals are in a position where a rally is made possible:

So the set up for a short term rally is in place. If the impulse off the Thursday high is not complete, ES 1939.50 and 1934.00 are levels to watch for a turn. One final note: in the above count wave 3 is shorter than wave 1, so wave 5 cannot exceed wave 3. Based on that observation, ES 1928.75 is the point at which waves 5 and 3 would be equal, so a continuation below that level will mean that something else is at play here - either the move is extending or it's forming something other than an impulse.

Backing out to a longer perspective, the ES has formed a double zig-zag from the Aug 24 crash low at 1831.00 into Thursday's spike high at 2011.75:

Saturday, September 12, 2015

Saturday, 9/12/15 update

Not a lot has changed since the update of last Saturday. The market continued to move sideways during the week with a push up to the ES 1990 area where it was rejected a couple of weeks ago and where it was rejected once again on Wednesday. Thursday and Friday were a sideways drift that has the look of a base for another bullish push.

The EW count in the above chart is only one of a number of possibilities. It is not necessarily the most likely except in the sense that it portrays a market relieving a severely "oversold" situation but not a market in the initial stages of an extended bull move - i.e. the market is taking a breather before continuing the bear trend that commenced last Spring.

There is proof that there is more to come from the bear. The Equity Oscillator - Daily (see the post of last Monday) is a tool developed in the mid '80's and tracked by the author since that time. The original version of the EOD has a periodicity of 7-10-10 days and generates peaks and troughs relatively quickly on a daily basis. When the 7-10-10 EOD registers a significant low it typically shoots up off that low as the maxed out legs of the indicator quickly move into positive territory. If the market has truly seen a significant price low then the upwards acceleration of the 7-10-10 EOD is accompanied by a sustained and rapid appreciation in price. So in those situations the EOD is signalling the kick-off to a new bull market. However, there are times when the thrust up by the EOD is not accompanied by an equivalent thrust in prices. Almost without fail those instances are a sign of a bear market rally that eventually rolls over.

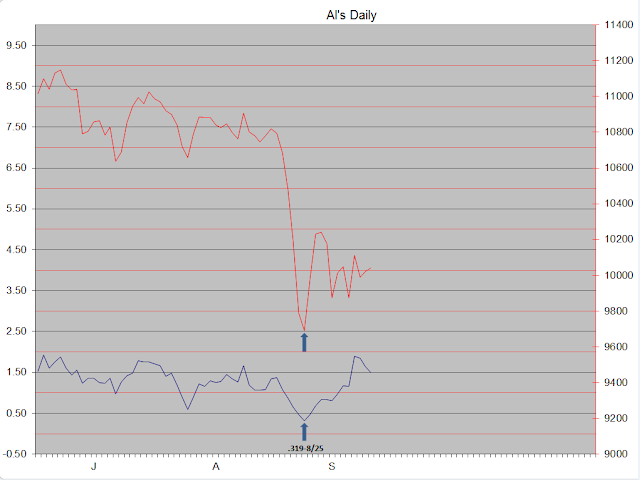

To illustrate, take a look at the 7-10-10 EOD charted against the NYA in 2009 (sorry, this chart is out of Excel, my trading platform does not have all the necessary stats to construct the EOD earlier than 2013):

On the left side of the chart note how the EOD (blue line at bottom of chart) shoots up off an oversold level near a reading of .50 in early March, 2009 and quickly peaks above 2.50 a week or so later. Meanwhile prices also shoot up off that low but continue to run higher in the following months with very little hesitation.

Now look at the same data for recent months:

Once again both the 7-10-10 EOD and prices shoot up together off a significant low, but now we see prices failing to sustain their upward momentum. That in turn appears to have capped the EOD. This is very much the picture of a bear market rally. So this analysis is signalling more bear market to come.

Monday, September 7, 2015

Monday, 9/7/15 The Equity Oscillator - Daily

First a note on the name: the oscillator was called "Al's Indicator"

which, let's face it, is kind of ......... klunky. Since it is an

oscillator based on NYSE composite daily statistics, the name Equity

Oscillator - Daily seems more apt.

The Equity Oscillator - Daily (EOD) is a compilation of daily NYSE Adv/Dec, volume and momentum statistics developed by the author in the mid-1980's before the advantage of today's PC based trading platforms. For years it was maintained by manual entry into digital spreadsheets - originally Lotus 1-2-3 and eventually Excel. With modern digital trading platforms it is possible to generate this oscillator real time and also to back test variations of the input time frames. The author has been doing just that in recent months. The original oscillator had a periodicity of 7, 10 and 10 days for the three oscillator components. The back test process revealed that oscillator values of 13, 19 and 19 days generated a more effective oscillator.

The EOD may be considered overbought at a reading higher than 2.00 and oversold below 1.00. It is combined with a trendline analysis to provide entry and exit signals for NYSE and NYSE derived indexes and vehicles. The trendline is usually derived by first drawing a regression line based on the daily closes for the trend in progress. Then a parallel line to the regression line is drawn and placed above or below the daily bars (depending on the direction of the trend) such that it touches the lowest daily low or highest daily high in the sequence in a manner that doesn't dissect another daily low or high. A picture is worth a thousand words, so here is a chart of some recent trends to illustrate the application:

Trade entries/exits are made when the EOD is at or very near overbought or oversold levels after cycling up or down from the preceding oversold or overbought level and the daily close has penetrated below or above the trendline defining the trend that has been in progress. This is assumed to signal a change in trend.

Any trading approach needs a stop loss component. The method employed here uses Wilder's ATR. The ATR for the instrument traded is multiplied by 2 and added or subtracted from the entry price to establish the stop loss point. It is the author's opinion that stop losses are disaster protection only and that setting SL's too close runs the risk of market noise preventing the trade from achieving what will ultimately be a winning position. Also, setting a SL quantifies the trade's risk for purposes of money management.

Finally, as in any system, there are times when a trade becomes a loser. Also, there are times when the oscillator stops oscillating. In both these situations, what has occurred is that the time periods used in the 13-19-19 EOD are not properly defining the cycles at work. The solution is to drop to the 7-10-10 EOD for trading signals, and once a successful trade has been generated then revert to the 13-19-19 EOD.

Below are the backtesting results for the EOD trading system. The ES (S&P E-mini futures) was used as the trading vehicle, but any NYSE derived vehicle should work. Because some of these trades span multiple months, if the ES were used there would need to be expiration month rollovers. To keep things simple this was not provided for in the simulation. If the ES were used as a trading vehicle it would probably make things easier if the out month contract were used instead of the nearest expiration. For example, if making a trade in the month of August use the December expiration rather than September.

The Equity Oscillator - Daily (EOD) is a compilation of daily NYSE Adv/Dec, volume and momentum statistics developed by the author in the mid-1980's before the advantage of today's PC based trading platforms. For years it was maintained by manual entry into digital spreadsheets - originally Lotus 1-2-3 and eventually Excel. With modern digital trading platforms it is possible to generate this oscillator real time and also to back test variations of the input time frames. The author has been doing just that in recent months. The original oscillator had a periodicity of 7, 10 and 10 days for the three oscillator components. The back test process revealed that oscillator values of 13, 19 and 19 days generated a more effective oscillator.

The EOD may be considered overbought at a reading higher than 2.00 and oversold below 1.00. It is combined with a trendline analysis to provide entry and exit signals for NYSE and NYSE derived indexes and vehicles. The trendline is usually derived by first drawing a regression line based on the daily closes for the trend in progress. Then a parallel line to the regression line is drawn and placed above or below the daily bars (depending on the direction of the trend) such that it touches the lowest daily low or highest daily high in the sequence in a manner that doesn't dissect another daily low or high. A picture is worth a thousand words, so here is a chart of some recent trends to illustrate the application:

Trade entries/exits are made when the EOD is at or very near overbought or oversold levels after cycling up or down from the preceding oversold or overbought level and the daily close has penetrated below or above the trendline defining the trend that has been in progress. This is assumed to signal a change in trend.

Any trading approach needs a stop loss component. The method employed here uses Wilder's ATR. The ATR for the instrument traded is multiplied by 2 and added or subtracted from the entry price to establish the stop loss point. It is the author's opinion that stop losses are disaster protection only and that setting SL's too close runs the risk of market noise preventing the trade from achieving what will ultimately be a winning position. Also, setting a SL quantifies the trade's risk for purposes of money management.

Finally, as in any system, there are times when a trade becomes a loser. Also, there are times when the oscillator stops oscillating. In both these situations, what has occurred is that the time periods used in the 13-19-19 EOD are not properly defining the cycles at work. The solution is to drop to the 7-10-10 EOD for trading signals, and once a successful trade has been generated then revert to the 13-19-19 EOD.

Below are the backtesting results for the EOD trading system. The ES (S&P E-mini futures) was used as the trading vehicle, but any NYSE derived vehicle should work. Because some of these trades span multiple months, if the ES were used there would need to be expiration month rollovers. To keep things simple this was not provided for in the simulation. If the ES were used as a trading vehicle it would probably make things easier if the out month contract were used instead of the nearest expiration. For example, if making a trade in the month of August use the December expiration rather than September.

2013

2/21/13 Sell @ 1502.00 3/4 Buy @ 1527.50 -- 25.50 loss

3/4 Buy @ 1527.50 5/23 Sell @ 1650.75 -- 123.25 gain

5/23 Sell @ 1650.75 7/5 Buy @ 1629.25 -- 21.50 gain

7/5 Buy @ 1629.25 7/29 Sell @ 1682.50 -- 53.25 gain

7/29 Sell @ 1682.50 9/4 Buy @ 1655.00 -- 27.50 gain

9/4 Buy @ 1655.00 9/20 Sell @ 1703.75 -- 48.75 gain

9/20 Sell @ 1703.75 10/10 Buy @ 1683.00 -- 20.75 gain

10/10 Buy @ 1683.00 11/5 Sell @ 1757.00 -- 74.00 gain

11/5 Sell @ 1757.00 11/15 Stopped @ 1790.00 -- 33.00 loss

11/20 Sell @ 1779.75 12/18 Buy @ 1804.00 -- 24.25 loss

2014

12/18/13 Buy @ 1804.00 1/2/14 Sell @ 1826.50 -- 22.50 gain

1/2 Sell @ 1826.50 2/6 Buy @ 1768.50 -- 58.00 gain

2/6 Buy @ 1768.50 3/11 Sell @ 1864.75 -- 96.25 gain

3/11 Sell @ 1864.75 4/16 Buy @ 1852.75 -- 12.00 gain

4/16 Buy @ 1852.75 7/17 Sell @ 1948.75 -- 96.00 gain

7/17 Sell @ 1948.75 8/8 Buy @ 1923.25 -- 25.50 gain

8/8 Buy @ 1923.25 9/8 Sell @ 2000.75 -- 77.50 gain

9/8 Sell @ 2000.75 10/21 Buy @ 1938.75 -- 62.00 gain

10/21 Buy @ 1938.75 12/8 Sell @ 2060.50 -- 121.75 gain

12/8 Sell @ 2060.50 12/18 Buy @ 2061.25 -- 0.75 loss

12/18/14 Buy @ 2061.25 1/6/15 Stopped @ 2004.25 -- 57.00 loss

1/20 Buy @ 2016.25 3/4 Sell @ 2096.25 -- 80.00 gain

3/4 Sell @ 2096.25 3/16 Buy @ 2067.00 -- 29.25 gain

3/16 Buy @ 2067.00 5/29 Sell @ 2106.00 -- 39.00 gain

5/29 Sell @ 2106.00

12/18/13 Buy @ 1804.00 1/2/14 Sell @ 1826.50 -- 22.50 gain

1/2 Sell @ 1826.50 2/6 Buy @ 1768.50 -- 58.00 gain

2/6 Buy @ 1768.50 3/11 Sell @ 1864.75 -- 96.25 gain

3/11 Sell @ 1864.75 4/16 Buy @ 1852.75 -- 12.00 gain

4/16 Buy @ 1852.75 7/17 Sell @ 1948.75 -- 96.00 gain

7/17 Sell @ 1948.75 8/8 Buy @ 1923.25 -- 25.50 gain

8/8 Buy @ 1923.25 9/8 Sell @ 2000.75 -- 77.50 gain

9/8 Sell @ 2000.75 10/21 Buy @ 1938.75 -- 62.00 gain

10/21 Buy @ 1938.75 12/8 Sell @ 2060.50 -- 121.75 gain

12/8 Sell @ 2060.50 12/18 Buy @ 2061.25 -- 0.75 loss

2015

12/18/14 Buy @ 2061.25 1/6/15 Stopped @ 2004.25 -- 57.00 loss

1/20 Buy @ 2016.25 3/4 Sell @ 2096.25 -- 80.00 gain

3/4 Sell @ 2096.25 3/16 Buy @ 2067.00 -- 29.25 gain

3/16 Buy @ 2067.00 5/29 Sell @ 2106.00 -- 39.00 gain

5/29 Sell @ 2106.00

Saturday, September 5, 2015

Saturday, 9/5/15 update

Probably the most difficult aspect of Elliott Wave is the fact that at any given market juncture there are usually multiple possible alternates. Right now that is the case. The preferred count on this site is that of a double zig-zag into the ES 1831 low of Aug 24. That low could have marked the bottom for Primary Wave IV. However, EW allows for up to three zig-zags in a multiple zig-zag sequence, so there is the possibility of further bear market. So was that it at 1831? The pattern since that low suggests that it wasn't.

An adage in market analysis is that markets develop tops and make bottoms - i.e tops tend to be rounded formations and bottoms tend to be V's. That's definitely been the case in the ES/SPX since the 2009 bear market bottom. The final lows in corrections during that time have tended to kick off sharp and sustained rallies for a couple of weeks or so. That's not what we're seeing since the Aug 24 low. So the preference has to be given to that of an "X" wave in progress (or a 4th wave, see below). In fact, it's possible that an "X" wave was complete at the Aug 27 high labeled as an Intermediate Wave "A" in the above chart. If that's the case, we should continue downward from here. It should be noted that the proposed "X" wave can take a number of forms and the projected labeling shown is only one of those possibilities.

Another alternate to be considered is that the entire drop from the mid-May all time highs is a developing "A" wave impulse of a simple zig-zag:

In this alternate the sequence since the Aug 24 low is a Minor W4. As can be seen, this alternate portends quite a bit of volatility yet to unfold. As usual, the dotted lines in the chart are there to represent the structure needed to complete the pattern and ARE NOT price and time projections.

Subscribe to:

Posts (Atom)