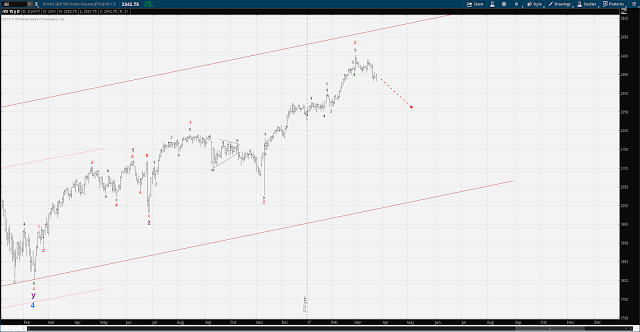

Alternate #1 - still working out Minor W3

However, it is possible to count the move off the Nov 9 low as complete at the Mar 1 high - and that would mean that the Mar 1 high is the Minor W3 top and we are in Minor W4 of an impulse that started at the lows of last June:

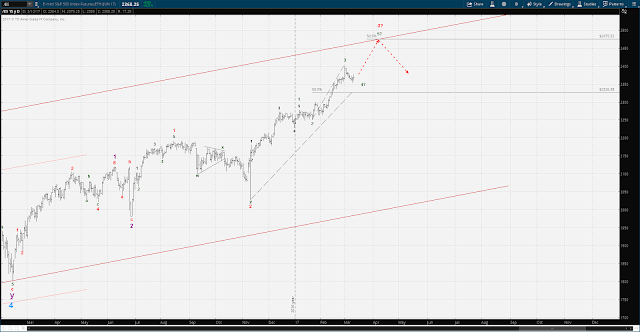

Alternate #2 - Minor W3 top is in, working out Minor W4

For perspective it should be noted that Minor W2 of the move lasted 3 months and spanned a drop in the ES of roughly 160 points.

NOTE: dotted lines show potential EW structures and are not necessarily accurate price/time forecasts