Pretty classic impulse structure up from the mid month lows with a top in the process of being formed.

Saturday, December 27, 2014

Saturday, December 13, 2014

Saturday, 12/13/14 update

There are a number of possibilities for the ES/SPX at this juncture. But before looking at those it's helpful to look at the long term picture.

Equities have been in a steady bull market since the Oct, 2011 lows. There is a very well defined channel outlining the move. The upper trendline of that channel has turned back the market at multiple points over the period and has thus provided strong resistance. The recent highs have bounced off of that trendline. If this count is correct, then the rally from the mid-October lows is the 5th wave of the bull market and thus is the last move up.

Zooming in, there are a number of possible alternates. The three most likely are as follows:

1st, Major W5 and thus Primary WIII complete at the Dec 5 highs, Intermediate Term bear market in its initial stages:

2nd, ES/SPX tracing out Inter W4 of Major W5, Inter W5 to follow into Major W5 top:

3rd, recent highs only marked the top of Inter W1 of Major W5, Inter W2 in progress with Inter W3, 4 & 5 yet to unfold:

All 3 alternates are possible, but the odds slightly favor the 1st one with a top of higher degree in place and the initial stages of an IT bear market occurring in the last week. An argument against the 2nd alternate is the lack of proportionality - if the recent selling is Inter W4 of the rally up from the mid-Oct lows then it is cutting much deeper than any of the other corrective sequences that have occurred during the move. It also cannot be fitted into any reasonable type of channel. The 3rd possibility would imply a lot more price appreciation yet to occur for the bull market, which would probably mean rocketing up past the upper trendline of the channel that delineates the last 3 years of the market. A trendline which has provided solid resistance over that period, as previously noted.

An Intermediate term change in trend from bull to bear would imply some type of major paradigm shift in the fundamentals. A case can be made for that. First, and most obvious, the Fed Reserve money pump that has been pumping liquidity into the financial markets has been turned off in the last 60 days.

Second, the Chinese economy has slowed drastically from it's torrid pace of recent years. It has to be recognized how interdependent the world economy has become, and one can no longer judge the prospects for U.S. financial markets without acknowledging that interdependence and how it may affect our economy. The Chinese economy now equates to that of the U.S., and the two combined outweigh the rest of the world by many magnitudes. So if the Chinese economy slows down it is bound to affect our economy to some extent, not to mention the rest of the world.

Finally, commodity prices worldwide have been in a bear market for some months now. That can be seen in the following chart of the CRB (Commodity Research Bureau) spot index:

The collapse in crude oil prices is part of this picture. This is negative for the worldwide economy and especially countries that rely on commodities for income. Yes, the U.S. economy is more service based and commodities are not a major economic driver, but there is no doubt they are weak and are a drag on our GDP, especially in the oil sector. And given world economic interdependence, if other parts of the world are tipping into a deflationary economic turmoil that could bode ill for us.

Equities have been in a steady bull market since the Oct, 2011 lows. There is a very well defined channel outlining the move. The upper trendline of that channel has turned back the market at multiple points over the period and has thus provided strong resistance. The recent highs have bounced off of that trendline. If this count is correct, then the rally from the mid-October lows is the 5th wave of the bull market and thus is the last move up.

Zooming in, there are a number of possible alternates. The three most likely are as follows:

1st, Major W5 and thus Primary WIII complete at the Dec 5 highs, Intermediate Term bear market in its initial stages:

2nd, ES/SPX tracing out Inter W4 of Major W5, Inter W5 to follow into Major W5 top:

3rd, recent highs only marked the top of Inter W1 of Major W5, Inter W2 in progress with Inter W3, 4 & 5 yet to unfold:

All 3 alternates are possible, but the odds slightly favor the 1st one with a top of higher degree in place and the initial stages of an IT bear market occurring in the last week. An argument against the 2nd alternate is the lack of proportionality - if the recent selling is Inter W4 of the rally up from the mid-Oct lows then it is cutting much deeper than any of the other corrective sequences that have occurred during the move. It also cannot be fitted into any reasonable type of channel. The 3rd possibility would imply a lot more price appreciation yet to occur for the bull market, which would probably mean rocketing up past the upper trendline of the channel that delineates the last 3 years of the market. A trendline which has provided solid resistance over that period, as previously noted.

An Intermediate term change in trend from bull to bear would imply some type of major paradigm shift in the fundamentals. A case can be made for that. First, and most obvious, the Fed Reserve money pump that has been pumping liquidity into the financial markets has been turned off in the last 60 days.

Second, the Chinese economy has slowed drastically from it's torrid pace of recent years. It has to be recognized how interdependent the world economy has become, and one can no longer judge the prospects for U.S. financial markets without acknowledging that interdependence and how it may affect our economy. The Chinese economy now equates to that of the U.S., and the two combined outweigh the rest of the world by many magnitudes. So if the Chinese economy slows down it is bound to affect our economy to some extent, not to mention the rest of the world.

Finally, commodity prices worldwide have been in a bear market for some months now. That can be seen in the following chart of the CRB (Commodity Research Bureau) spot index:

The collapse in crude oil prices is part of this picture. This is negative for the worldwide economy and especially countries that rely on commodities for income. Yes, the U.S. economy is more service based and commodities are not a major economic driver, but there is no doubt they are weak and are a drag on our GDP, especially in the oil sector. And given world economic interdependence, if other parts of the world are tipping into a deflationary economic turmoil that could bode ill for us.

Saturday, December 6, 2014

Saturday, November 29, 2014

Saturday, November 22, 2014

Saturday, November 15, 2014

Saturday, 11/15/14 update

This thing looks ripe for a correction:

But the run up from the mid-October lows could well be just Intermediate W1 of Major W5 rather than the entirety of Major W5, so a short duration correction may be all that occurs. Seasonally their is a bullish bias in the coming months, especially in December.

But the run up from the mid-October lows could well be just Intermediate W1 of Major W5 rather than the entirety of Major W5, so a short duration correction may be all that occurs. Seasonally their is a bullish bias in the coming months, especially in December.

Saturday, November 8, 2014

Saturday, 11/8/14 update

The ES/SPX has moved up impressively since the mid-October low. Any number of technical measurements are showing an "overbought" situation, including Al's Daily indicator as can be seen below. This rendering has the formula based off a 20 day time frame, as can be seen it's been a respectable identifier of market tops over the last couple of years (note that the price chart is the NYSE).

The EW pattern of the current rally was fairly straightforward through Oct 31st, but the last week of action has gotten a little muddy. Thus there are a number of ways to label the short term count, below are the two most likely alternatives:

There are a couple of things to note in these charts. First, there are enough waves to count a close to complete or actually completed structure off the mid-October low. Second, it's apparent that the rally has lost some steam over the last week - the rate of ascent is visibly weaker. Of course, the market could just be basing for further sharp rally, but the odds are that a correction of some sort is more likely in the very near future.

From a longer term perspective the market is at a critical inflection point.

Major W1 (see legend on right) of the bull market that started in October, 2011 was a fast and furious run up that lasted 18 days and climbed 221 points. Major W5 since the recent mid-October lows has climbed 220.50 points in 17 trading days through Friday. Major W5 = Major W1 at ES 2034.25. Friday's high of 2033.50 is almost a direct hit of that target. So if Major W5 is going to duplicate Major W1 then the top to Primary W III is very close if not already achieved. However, Major W5 could very well extend, and thus a top here could well be only the high for Intermediate W1 of Major W5. That would mean a lot more bull market yet to occur in the coming months.

The EW pattern of the current rally was fairly straightforward through Oct 31st, but the last week of action has gotten a little muddy. Thus there are a number of ways to label the short term count, below are the two most likely alternatives:

OR

There are a couple of things to note in these charts. First, there are enough waves to count a close to complete or actually completed structure off the mid-October low. Second, it's apparent that the rally has lost some steam over the last week - the rate of ascent is visibly weaker. Of course, the market could just be basing for further sharp rally, but the odds are that a correction of some sort is more likely in the very near future.

From a longer term perspective the market is at a critical inflection point.

Major W1 (see legend on right) of the bull market that started in October, 2011 was a fast and furious run up that lasted 18 days and climbed 221 points. Major W5 since the recent mid-October lows has climbed 220.50 points in 17 trading days through Friday. Major W5 = Major W1 at ES 2034.25. Friday's high of 2033.50 is almost a direct hit of that target. So if Major W5 is going to duplicate Major W1 then the top to Primary W III is very close if not already achieved. However, Major W5 could very well extend, and thus a top here could well be only the high for Intermediate W1 of Major W5. That would mean a lot more bull market yet to occur in the coming months.

Saturday, November 1, 2014

Saturday, 11/1/14 update

If this count is correct then the ES is in the 5th wave (Major W5) of the bull market that started Oct 2011. Major W1 was a fast and furious run up that lasted 18 days and climbed 221 points. Major W5 has climbed 204 points in 12 trading days through Friday. Major W5 = Major W1 at ES 2034.25, only 17.50 points up from Friday's high. So if Major W5 is going to duplicate Major W1 then the top to Primary W III is very close.

Internal count for Major W5 has the ES midway through an extended Minor W5 of Intermediate W3 off the Oct 15 Major W4 low. The top for Minor W5 will be followed by Inter W4 & W5 into a very significant long term peak.

Classic market theory holds that at market tops less and less individual issues participate. Following is the amount of the September to October sell off that has been retraced by a number of indexes since the mid October lows:

DJIA 103.0%

SPX 99.4%

NYSE 78.5%

RUT 77.3% (measured from the July high)

As can be seen, the broader based the index the less the retrace, which would lend credence to the idea that a top is in the process of being formed.

Thursday, October 23, 2014

Thursday, 10/23/14 update

What does the US Forest Service and the Federal Reserve have in common?

The US Forest Service has Smokey the Bear. Smokey was developed in the 1940's as part of a campaign to prevent forest fires. Forest fires were considered a threat to human welfare, so the push was on to prevent them. And a successful push it was. Except that it was determined in recent years that forest fires were actually beneficial - they served to clear out the underbrush and deadwood in the wildlands. Without the aid of periodic cleansing a forest becomes dense and overgrown. Inevitably a forest fire does occur, and it's far more destructive and uncontrollable than otherwise would be the case.

The Federal Reserve has Rocket the Bull (could probably add a four letter expletive to "Bull" and still be accurate). Otherwise known as the PPT (Plunge Protection Team). What many of us have long suspected has now become known as true. In recent years our friendly central bankers have actively intervened in the stock market via S&P 500 futures any time things got a little shaky. You see, it was determined that bear markets are a threat to human welfare. Also, and probably more to the point, the welfare of politicians and certain powerful bureaucrats. It occurs to me that the analogy to proper forest management is spot on - bear markets clear out the underbrush and deadwood. Without them the inevitable stock market forest fire is likely to be quite destructive and - yes- uncontrollable.

--------------------------------------------------------------------------------------------------------------------------

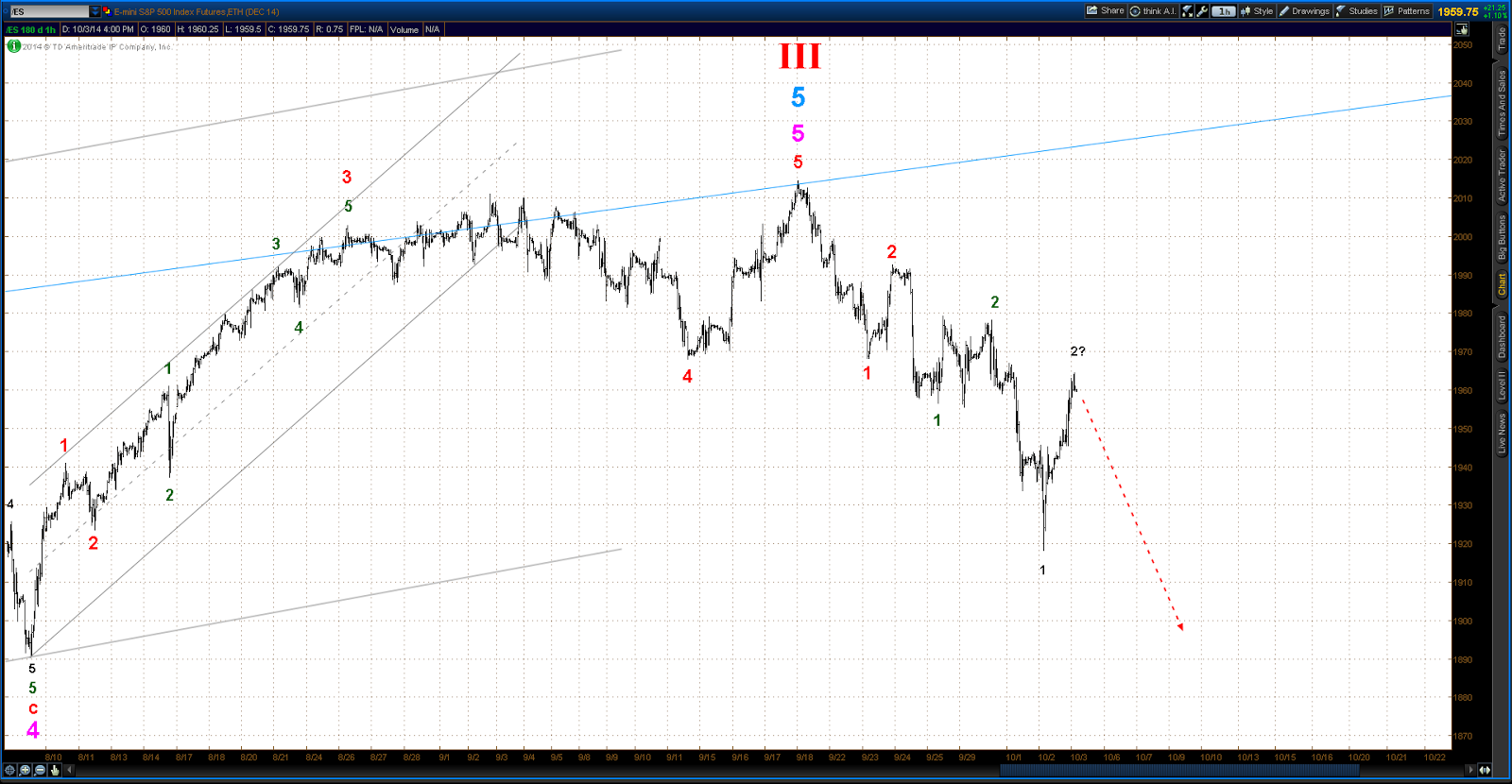

Above is the EW count I've been maintaining for the ES up until this week. But the action since the Wed, Oct 15 lows has taken a clearly impulsive form. Also, the drop from the Sep 19 high into last weeks lows is only 3 waves at best, for certain it's choppy nature did not form a completed 5 wave impulse. So the odds that the recent drop was just a short term correction and that new ATH's are forthcoming are high. So their is an alternate long term count that has to be considered:

As can be seen, the alternate has an extended Intermediate W5 in Major W3 so that the top for Major W3 is pushed out from last December to the recent Sep 19 high. This means that the recent correction is Major W4 of Primary W III with Major W5 currently in progress. Note that Major W5 will equal the travel of Major W1 at ES 2034.25. The interesting thing about this is that a channel drawn around the move up off of last week's lows shows the ES hitting that 2034.25 level right around election day the week after next. Hmmm.............

The US Forest Service has Smokey the Bear. Smokey was developed in the 1940's as part of a campaign to prevent forest fires. Forest fires were considered a threat to human welfare, so the push was on to prevent them. And a successful push it was. Except that it was determined in recent years that forest fires were actually beneficial - they served to clear out the underbrush and deadwood in the wildlands. Without the aid of periodic cleansing a forest becomes dense and overgrown. Inevitably a forest fire does occur, and it's far more destructive and uncontrollable than otherwise would be the case.

The Federal Reserve has Rocket the Bull (could probably add a four letter expletive to "Bull" and still be accurate). Otherwise known as the PPT (Plunge Protection Team). What many of us have long suspected has now become known as true. In recent years our friendly central bankers have actively intervened in the stock market via S&P 500 futures any time things got a little shaky. You see, it was determined that bear markets are a threat to human welfare. Also, and probably more to the point, the welfare of politicians and certain powerful bureaucrats. It occurs to me that the analogy to proper forest management is spot on - bear markets clear out the underbrush and deadwood. Without them the inevitable stock market forest fire is likely to be quite destructive and - yes- uncontrollable.

--------------------------------------------------------------------------------------------------------------------------

Above is the EW count I've been maintaining for the ES up until this week. But the action since the Wed, Oct 15 lows has taken a clearly impulsive form. Also, the drop from the Sep 19 high into last weeks lows is only 3 waves at best, for certain it's choppy nature did not form a completed 5 wave impulse. So the odds that the recent drop was just a short term correction and that new ATH's are forthcoming are high. So their is an alternate long term count that has to be considered:

As can be seen, the alternate has an extended Intermediate W5 in Major W3 so that the top for Major W3 is pushed out from last December to the recent Sep 19 high. This means that the recent correction is Major W4 of Primary W III with Major W5 currently in progress. Note that Major W5 will equal the travel of Major W1 at ES 2034.25. The interesting thing about this is that a channel drawn around the move up off of last week's lows shows the ES hitting that 2034.25 level right around election day the week after next. Hmmm.............

Saturday, October 18, 2014

Saturday, 10/18/14 upate

Very difficult pattern to analyze in EW terms since the Sep 19 ATH. Although the market was quite "oversold" by just about any measure by mid-week the EW count looks like it needs at least one more thrust down to new lows for the move. A possible target area is between 1801.25 where Intermediate W3 = 3 x Intermediate W1 and 1791.00 where Minor W3 = 3 x Minor W1. If this downdraft develops it will likely generate momentum divergences on a variety of technical indicators and could be an opportunity for a long play. But extreme caution should be exercised in that eventuality.

Long term view:

Notice how that 1795 - 1805 area has acted as a pivot in the last year.

Sunday, October 12, 2014

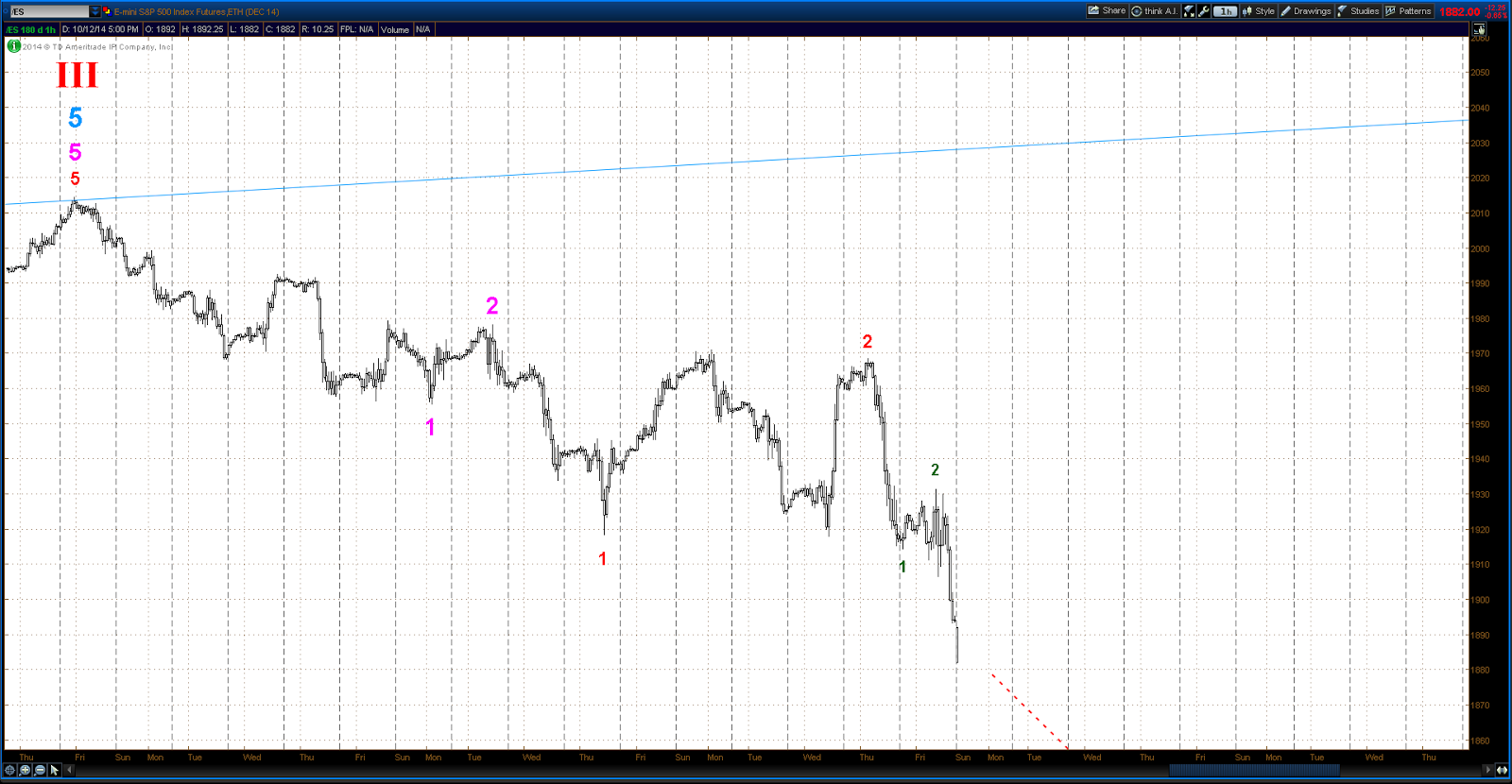

Sunday, 10/12/14 update

Epic bull/bear battle last week, but the bears were decidedly victorious, inflicting considerable technical damage in the process. The top for the three year bull market dating back to Oct 2011 is confirmed as in place. Current EW count is that the Sep 19 highs are the top for Primary Wave III of the long term uptrend dating back to the Mar '09 lows. Primary Wave II was a flat, and the C wave of that structure lasted 5 months and took around 25% off the ES/SPX. Primary Wave IV is now in progress and should alternate with a zig-zag or triangle. It should roughly equate to Primary W II in price damage and duration.

The short term picture shows a quite choppy pattern since the Sep 19 ATH. The best count is that of a series of nested 1st & 2nd waves as below, but this will quite probably have to be revised as the move matures.

One final note. The fact is that there are only 3 completed waves up off the Mar '09 lows. Thus the possibility that the whole run from those lows is in fact a corrective wave still remains open. This would portend a crash more severe than that of 2007 - 2009. Odds of this being the case have to be regarded as low at this point, but it is possible.

The short term picture shows a quite choppy pattern since the Sep 19 ATH. The best count is that of a series of nested 1st & 2nd waves as below, but this will quite probably have to be revised as the move matures.

One final note. The fact is that there are only 3 completed waves up off the Mar '09 lows. Thus the possibility that the whole run from those lows is in fact a corrective wave still remains open. This would portend a crash more severe than that of 2007 - 2009. Odds of this being the case have to be regarded as low at this point, but it is possible.

Saturday, October 4, 2014

Saturday, 10/4/14 update

One would like to think that a significant top in equities was seen in mid September and that the long awaited bear market correction is in progress. Certainly looked that way earlier this week. But "Al's Daily Indicator" signaled the likelihood of a bounce of some sort on Thursday and sure enough the ES moved up sharply off of Thursday's lows and continued rallying into Friday's close.

So the intermediate term trend is still an open question. A move above ES 1980 will greatly increase the odds that the trend is still up and new ATH's are forthcoming. The alternate counts are as follows:

Top already in:

Top not yet achieved:

So the intermediate term trend is still an open question. A move above ES 1980 will greatly increase the odds that the trend is still up and new ATH's are forthcoming. The alternate counts are as follows:

Top already in:

Top not yet achieved:

Tuesday, September 30, 2014

Tuesday, 9/30/14 update

This indicator is now in buy territory (below 1.000), actually it dropped to below 1.000 as of yesterday's close. The problem here is that the EW pattern is not entirely clear, at least with respect to the ES/SPX. NYA looks like it might be forming an ending diagonal 5th wave.

Saturday, September 27, 2014

Saturday, 9/27/14 update

Listening to and reading the financial commentators in the last couple of days there's the usual blather about corporate earnings, equity valuation levels (not over valued yet is the general opinion - naturally), GDP growth, etc., all leading to the conclusion that there's no need to bail out of equities. And they might be right. But there is no doubt that one very important driver of equity prices since 2009 is shutting down, and that's the Fed Reserve money machine. So from that standpoint it has to be admitted that there is some cause for concern. The effect of the Fed tapering is pretty obvious in the DX - old bucky has been blowing through the roof and is not showing signs of letting up. Why? Because the potential return to US$ denominated assets is relatively greater than those elsewhere in the world because there is the anticipation of higher interest rates as a result of Fed tapering. Which brings us back to the outlook for equities. For five years now there has been no opportunity for return from the fixed income sector because interest rates have been deliberately suppressed. Now that equation looks to be changing, and we may be seeing the beginning of a major shift in portfolio asset allocations out of equities and into fixed income vehicles. Which does not bode well for equity prices. Less demand = lower price.

----------------------------------------------------------------------------------------------------------------------------

Since the ATH of Sep 18 the ES/SPX has put in two impulse moves down. At this point if a significant intermediate term top was established at that high the market has yet to confirm it with a completed 5 wave bear sequence. Since the rally off Friday morning's low overlapped the low of the 1st down impulse which bottomed on Sep 23, then the ES has either established a nested series of 1st and 2nd waves as in the below chart or the selling is over with a simple zig-zag A-B-C ending at Friday's low. If we are seeing a nested wave 1-2 series then the market is headed a lot lower and the odds are very good that the Sep 18 ATH is in fact a significant IT top. If this has been a garden variety correction then new ATH's should be forthcoming in the very near future.

If the ES continues lower a level that bears watching is the 1938.25 to 1934.50 area. The volume profile chart (below) shows a "volume hole" in that area. Also, it so happens that a .618 retrace of the early Aug through mid Sep rally lands at 1937.75, right at the upper edge of that volume hole. If the ES powers through that area the race to the exit doors could be on.

----------------------------------------------------------------------------------------------------------------------------

Since the ATH of Sep 18 the ES/SPX has put in two impulse moves down. At this point if a significant intermediate term top was established at that high the market has yet to confirm it with a completed 5 wave bear sequence. Since the rally off Friday morning's low overlapped the low of the 1st down impulse which bottomed on Sep 23, then the ES has either established a nested series of 1st and 2nd waves as in the below chart or the selling is over with a simple zig-zag A-B-C ending at Friday's low. If we are seeing a nested wave 1-2 series then the market is headed a lot lower and the odds are very good that the Sep 18 ATH is in fact a significant IT top. If this has been a garden variety correction then new ATH's should be forthcoming in the very near future.

If the ES continues lower a level that bears watching is the 1938.25 to 1934.50 area. The volume profile chart (below) shows a "volume hole" in that area. Also, it so happens that a .618 retrace of the early Aug through mid Sep rally lands at 1937.75, right at the upper edge of that volume hole. If the ES powers through that area the race to the exit doors could be on.

Saturday, September 20, 2014

Saturday, 9/20/14 update

There is a distinct difference in equity markets as opposed to commodity markets. In commodity markets the underlying tension between bulls & bears is such that neither side has a long term edge, i.e. neither side will dominate the long term slope of the market. In the end commodity pricing will reflect the real world underlying demand/supply equation. Increasing demand leads to higher prices and eventually leads to increased supply, which in turn leads to lower prices and eventually less supply, rinse, repeat. However, in equities almost the entirety of society wants higher prices - from the financial industry to the politicians to the guy next door. The exception of course is the very small community of traders who crave bear markets because of their potential for very quick and sizable profits. So the long term bias in equities is definitely up.

It's been over 5 years since the Mar '09 lows that followed the '08 crash. The equities markets grind steadily upwards, and every time the EW analysis shows the possibility of a top the market manages to truck on through anyway with extension after extension of the EW count. As mentioned, the bias is definitely towards north, and the mindless BTFD'ers are right more often then not. Such is the case at the moment. Although the EW count would appear to portend a significant top in the offing, it's fairly likely that the expected top is not here quite yet.

It's been over 5 years since the Mar '09 lows that followed the '08 crash. The equities markets grind steadily upwards, and every time the EW analysis shows the possibility of a top the market manages to truck on through anyway with extension after extension of the EW count. As mentioned, the bias is definitely towards north, and the mindless BTFD'ers are right more often then not. Such is the case at the moment. Although the EW count would appear to portend a significant top in the offing, it's fairly likely that the expected top is not here quite yet.

Alternate #1

Alternate #2

Intermediate

W4 was done at the 1890.25 low of Aug 7. The rally that ensued had two

clear impulse structures into the highs of Aug 26 (labeled Minute W3 in

Alternate #1 and Minor W3 in Alternate #2). Following that the ES/SPX

embarked on an over two week long muddied and sideways track into the

lows of Sep 14 followed by a thrust into the 2014.50 high of Friday.

That last rally is the tell. Although the entire sequence since the

Intermediate W4 low can potentially be counted as a completed Inter W5

move as in Alternate #2, the problem is that last week's rally is almost

certainly a three wave move rather than a five. The sell off after the

Thur/Fri overnight high overlapped the presumed 1st wave high of the

move. So either the rally is over and it's a B wave in an expanded flat

as in Alternate #1 or an ending diagonal is in the process of being

formed. If an expanded flat is being formed then wave C of the

structure is likely in progress. Targets here are at the 50% retrace of

1950.50 and (more likely) the .618 retrace of 1936.50. If an ending

diagonal is in play then the target high has to be somewhere south of

2021.00 to fit EW rules.

Saturday, September 6, 2014

Saturday, 9/6/14 update

Range bound market the last two weeks with a lower limit of roughly ES 1990 and upper limit roughly ES 2010. From a short term trading standpoint it's a whipsaw from hell unless you're very nimble. However it does look like a top is being formed. Often the first breakout of a range bound market is a head fake, and if the below EW count is correct then that's exactly what will transpire.

Saturday, August 30, 2014

Saturday, 8/30/14 update

Intermediate

W4 was done at the 1890.25 low of Aug 7. Since then Minor Waves 1, 2

& 3 of Inter W5 look complete with the distinct possibility that

Inter W4 is also done at the 1987.50 low of Aug 28. If so Inter W5 is

in progress and will terminate at the important long term top of Major

W5 of Primary W III. A possible target is at 2013.00 where Minor W5 =

.50 x Minor W1. This target lines up well with an Intermediate W5

target of 2012.50 where Inter W5 = .786 x Inter W1.

An

alternate possibility is that Inter W5 will be an extended wave, in

which case the ES/SPX would still be in Minor W1 of Inter W5 with the

nearby projected top being the conclusion of Minor W1. This alternate

would portend a lot more distance yet to travel in terms of both price

and time for Inter W5.

Thursday, August 21, 2014

Thursday, 8/22/14 update

Steady ramp up in the ES/SPX since the Aug 8 lows. The bearish alternate count presented the last couple of weeks is obviously now eliminated.

If this count is correct then the ES is in the 5th of a 5th wave of the bull market dating back to the October '11 lows. In other words the end game. Possible targets are at 2012.50 where Inter W5 = .786 x Inter W1 and after that at 2045.75 where Inter W5 = Inter W1.

If this count is correct then the ES is in the 5th of a 5th wave of the bull market dating back to the October '11 lows. In other words the end game. Possible targets are at 2012.50 where Inter W5 = .786 x Inter W1 and after that at 2045.75 where Inter W5 = Inter W1.

Saturday, August 16, 2014

Saturday, 8/16/15 update

Friday's high at ES 1961 marked a 70 point bounce off the low of Friday Aug 8. Nice jump so far, but it needs to be pointed out that 40 points of that move all occurred on the 1st day. The bullish preferred EW count shows a series of nested waves 1 & 2 off the Aug 8 low, if so there should be some upside acceleration immediately ahead. If not this market could be in trouble as shown in the alternate count, which has the ES tracing out an ending diagonal "c" wave of an irregular flat 2nd wave of a developing bear market.

Preferred count

Alternate count

Sunday, August 10, 2014

Sunday, 8/10/14 update

The evidence that the selling in the ES/SPX that commenced in late July is done (for the time being) is pretty strong. Wave counts from the July 24th highs into Friday's lows can be counted as complete. In addition, market statistics as measured by Al's Indicator are in buy territory:

Preferred Count

Alternate Count

The big question at this juncture is weather the bounce off of Friday's lows is just that - a bounce - or are we going to see a run to new highs. One key level is that which was pointed out in last weeks update - the assumed Intermediate W1 high of 1887.50 of early March. If the selling resumes without new highs occurring and prices poke below that 1887.50 level then the odds of a major top being in place increase significantly. On the other hand, if the current bounce moves up past the 80% retrace level of the recent sell off then new ATH's are highly likely. That level is at ES 1969.25. Meanwhile the form of the bounce will be a good tell. If it is strongly impulsive then new ATH's are likely, if it is choppy and overlapping then continued selling is likely in the cards. So far it's been pretty impulsive looking.

Saturday, August 2, 2014

Saturday, 8/2/14 update

The current preferred count has the ES in Inter W4 of Major W5 up off the Feb 5 low at 1732.00. Inter W2 was a flat, so by rule of alternation Inter W4 should be either a zig-zag or triangle. So far the ES shows 3 waves down from the Inter W3 top at 1985.75 on Jul 24, so if the low for Inter W4 is in place or near at hand the EW requirements for the move have been met.

The internal count for the move off the Jul 24 top has Minor wave "a" bottoming at the 1960.75 low of Jul 28, wave "b" top at the 1979.50 high of Jul 29 with Minute waves 1 thru 3 of Minor wave "c" complete into Friday's 1910.25 low print. If correct the move only needs Minute waves 4 & 5 to complete Minor wave "c" and thus Inter W4.

First possible target for the correction is at 1904.50 where Minor wave "c" will be 3 x Minor wave "a". There is also a "volume hole" at 1904.25 (see chart below). Next possible target is at 1894.50 which represents a .50 retrace of Inter W3.

Longer term perspective shows the ES moving towards the conclusion of the current bull market which commenced at the Oct 2011 low at 1068.00 - close to 3 years in duration and a doubling in price, quite an impressive run.

Concerning the current sell-off, a price level of significance is at 1887.50. This is the peak of Inter W1 in the preferred count. If the ES continues dropping and pierces down through that level there will be a 4th wave overlap of wave 1, which is an EW no-no. In that eventuality the possibility that Primary W III has already topped at the recent highs becomes the preferred count as per the below alternate. If the Primary W III top is in place then the market is at the very early stages of a deeper and more severe bear market than has been seen since 2011 when the ES dropped over 25% in the space of a few months.

Finally I'd like to share some work with not a lot of description (it's late PM Saturday) but which may be of interest. I have a proprietary market indicator that was 1st developed in the mid 1980's which is dubbed "Al's Indicator". The data base for the indicator was originally in a Lotus spreadsheet and was then migrated to Excel. In the last couple of years my trading/charting platform (TOS) has made the base data used in the indicator's formula available. A TOS routine was written to use that data to generate Al's Indicator in their platform. The original indicator had 3 variables in the formula, and it was cumbersome to manipulate those variables using an Excel spreadsheet. However, expressing the indicator in the TOS trading platform allowed for easy variation and testing of the inputs, so I've been playing with that. The below chart shows "Al's Indicator" against the NYA with three different variable sets. As I said I'm not going to spend a lot of time discussing the chart, but I'd like to point out that the 1st variation (which is the original in terms of variables) has the market in buy territory as defined by this indicator.

The internal count for the move off the Jul 24 top has Minor wave "a" bottoming at the 1960.75 low of Jul 28, wave "b" top at the 1979.50 high of Jul 29 with Minute waves 1 thru 3 of Minor wave "c" complete into Friday's 1910.25 low print. If correct the move only needs Minute waves 4 & 5 to complete Minor wave "c" and thus Inter W4.

First possible target for the correction is at 1904.50 where Minor wave "c" will be 3 x Minor wave "a". There is also a "volume hole" at 1904.25 (see chart below). Next possible target is at 1894.50 which represents a .50 retrace of Inter W3.

Longer term perspective shows the ES moving towards the conclusion of the current bull market which commenced at the Oct 2011 low at 1068.00 - close to 3 years in duration and a doubling in price, quite an impressive run.

Concerning the current sell-off, a price level of significance is at 1887.50. This is the peak of Inter W1 in the preferred count. If the ES continues dropping and pierces down through that level there will be a 4th wave overlap of wave 1, which is an EW no-no. In that eventuality the possibility that Primary W III has already topped at the recent highs becomes the preferred count as per the below alternate. If the Primary W III top is in place then the market is at the very early stages of a deeper and more severe bear market than has been seen since 2011 when the ES dropped over 25% in the space of a few months.

Finally I'd like to share some work with not a lot of description (it's late PM Saturday) but which may be of interest. I have a proprietary market indicator that was 1st developed in the mid 1980's which is dubbed "Al's Indicator". The data base for the indicator was originally in a Lotus spreadsheet and was then migrated to Excel. In the last couple of years my trading/charting platform (TOS) has made the base data used in the indicator's formula available. A TOS routine was written to use that data to generate Al's Indicator in their platform. The original indicator had 3 variables in the formula, and it was cumbersome to manipulate those variables using an Excel spreadsheet. However, expressing the indicator in the TOS trading platform allowed for easy variation and testing of the inputs, so I've been playing with that. The below chart shows "Al's Indicator" against the NYA with three different variable sets. As I said I'm not going to spend a lot of time discussing the chart, but I'd like to point out that the 1st variation (which is the original in terms of variables) has the market in buy territory as defined by this indicator.

Subscribe to:

Comments (Atom)