There are two things that happen with regularity in Washington that just annoy me to no end. One relates directly to the current market environment and the second doesn't.

So let's take the second one first. That is a thing called "baseline budgeting". In baseline budgeting an increase is proposed in federal spending - that new level is termed the "baseline". Then the politicians propose a reduction in the rate of increase and claim that they have reduced spending!! As a simplified example lets say that last years expenditures in the Dept of Nonsense were $100 billion. The Dept of Nonsense then proposes a budget for next year of $110 billion. The politicians confer and then announce that next years Dept of Nonsense budget will be $105 billion and that they have thus cut spending by $5billion! Hooray for you oh brave politicians. What a lying pack of thieves.

The other annoyance is a thing called static analysis. This refers to a method of analyzing the economic impact of tax policy that assumes a straight line relationship between a change in tax rates and the resultant increase or decrease in tax revenue. So if tax rates are increased by 10% it is assumed that there will be 10% more revenue gained. No consideration is given to the thought that people will change their behavior as a result of changes in tax policy. But it is a historical and provable fact that the more tax rates increase the more people will alter their economic behavior in an effort to mitigate the impact of those higher rates. This is called dynamic analysis.

Further, individuals are likely to take steps to avoid higher tax rates that they

anticipate will occur. Which brings us to the current situation in equities. It appears likely at this point that there will be an increase in tax rates in 2013, to include a drastic jump in the capital gains and dividend tax rates. So it would seem reasonable to expect people to liquidate assets and book the capital gains in 2012 where the cap gains tax may be significantly lower than in 2013.

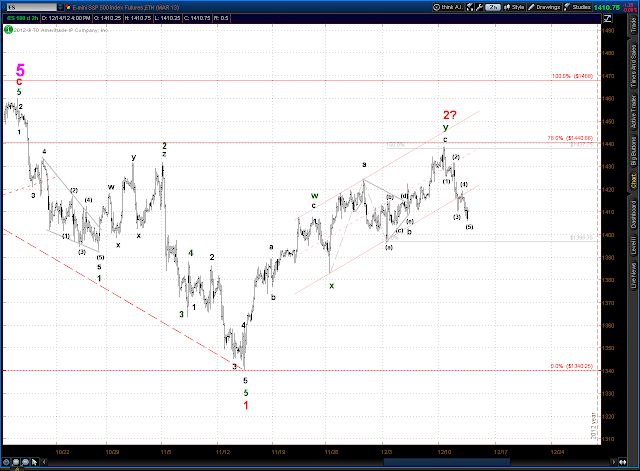

The pattern in the ES/SPX since the Nov 16 low has been much more corrective than impulsive to this point. Lots of choppiness and wave overlaps. You get the sense of a bearish undercurrent, and the thinking above may be what's in play. The bear alternate below translates that bearish looking pattern into a double zig-zag. Multiple zig-zag corrections can contain up to three zig-zag formations, and since the ES appears to be in the 2nd zig-zag since the Nov 16 low it is allowable for the market to continue to grind out more choppy action with an upward bias for a while yet. This may be the way that the normal holiday bullish bias gets expressed.

Bear alternate

The bullish alternate shows a series of waves 1 & 2 of ever less degree unfolding since the Nov 16 low. If this is correct than prices should embark on a strong ramp up in a 3rd of a 3rd of a 3rd wave in the immediate future.

Bull alternate