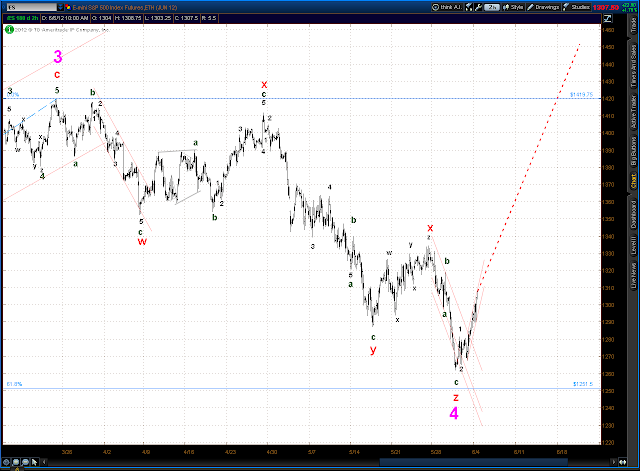

Pretty stout move up has developed off the Sunday night lows. Alternate #2 presented in recent weeks (see Sunday post) has to be given strong consideration at this point. The drop from the late March highs into the recent low at ES 1262.00 can be counted as a triple zig-zag.

Longer term view has the ES in an ending diagonal C wave off the lows of last October with an eventual target around the 2007 highs.

Zoomed out

Wednesday, June 6, 2012

Subscribe to:

Post Comments (Atom)

Hey there Al. Great comment yesterday about the apparent "corrective" action could very well morph into a huge impulse. I too have see things like that happen but I was so overwhelmed with the bearish look of it that I bailed out of longs and just stood aside. Missed the entirety of today's move higher.

ReplyDeleteSo my game plan is to await a pullback and jump back on board the bull train. But my god is your forecast bullish. In no way do I discount it though... it's just that I simply can't perceive of how it would be possible in light of the horrendous happenings in Europe. I say that with total respect of course and like I said, I don't discount your opinion in the slightest. For one thing, I've been a bit hamstrung by the fact that the recent decline off the April 2 high looks to me to be a clear fiver. That would imply that the next bounce is an 'abc' affair. However, your vision is that the decline was possibly a triple zigzag instead.

I have never declared to be a particularly good EW technician but my first thought is that the decline off the April 2 high simply looks like a fiver. It wouldn't cross my mind to apply what I'd consider to be a "more radical" count, such as a triple zigzag. Perhaps it's not radical at all, so my mind is open to your perspectives. I'm glad I ran into you and wish you the very best.

Hey AR. Yes, that is a radical count. But consider that the 2007 highs are in the ES 1580 area, as I write this the ES is trading @ 1317, so ES 1580 is 263 points away - and since the Sunday night low @ ES 1262 we're up 55 points in 3 days. Not saying that we're going straight up, markets never do, just pointing out that it's not as far as it may seem.

ReplyDeleteAs far as the internals on the count, I agree the move down from the peak on March 27 is 5 legs and can be counted as an impulse - heck, there's even alternation between the corrective waves. However, on the ES the first and last leg are much more easily counted as 3's rather than 5's- the last leg was the recent drop from May 29 through Sunday night, weren't we all looking for a 5th wave which never showed up? So it's more a 3 than a 5, although I can get a 5 out of it but it looks very odd.

Also, you need to know the ending diagonal C wave in this post is my ALTERNATE count - the odds of it being correct have increased with the current rally, but my PREFERRED count is almost identical to Pretzel's. So I agree, it's hard to see how we can run up to the 2007 highs with all the turmoil in world financial markets. On the other side of the argument is the fact that it's an election year, the Prez and the Beard are going to do everything in there power to float the markets. Remember there's a lot of vested interests in a rising stock market.

As far as the call yesterday, it smelled like a rally was in the works. Also, I had buy signals on my 2 main trading systems - one based on ten minute charts and the other on 60 minutes. What's burning me is I didn't take action on them, like you I was to wrapped up in the search for the 5th wave that never showed up. The social animal in me likes these trading blogs, but more than once they've clouded my opinion - guess there's some personal psychology there that I need to examine.

Anyway, nice to hear from you, thanks for the feedback.

My apologies for not getting back here for 3 days Al. You know how it is... so darned much to read, so busy studying our own charts... and for me, holding a job as well.

ReplyDelete"The social animal in me likes these trading blogs, but more than once they've clouded my opinion."

Me too Al. That's why (not sure if you've noticed or not) I have pulled in my horns considerably as of late. Whether we want to admit it or not, we 'are' (at least subconsciously) affected by so many opinions of others. And I guess it's natural that we tend to gravitate toward those who share our own opinions. Is that a good thing? Not necessarily because that practice just tends to reinforce our own views which themselves may or 'may not' be correct.

I think it's best that we listen to a 'chosen few' other people and try to limit the noise to those who's opinions are at least based on some pretty good talent and observations. Then we make our own decisions from there and stay nimble. At this very moment in time (Sunday, June 10th) I'm seeing so darned many reliable bullish signals that I have no choice but to obey them. I have no idea whether or not it's just portending a bounce or if perhaps there's something much more bullish in the wind than I like to admit as even being possible, in light of the deflationary forced growing by the day.

But are they really growing by the day? Maybe not. What if some sort of 'solution' comes out of Europe that is 'good enough' to provide a rally that lasts 6 months? Although I can't envision that, the charts tell me that at the very least the markets want to head higher. How much higher... I do not know.

All the best!

Dan