Will there ever again be a bear market in equities worthy of the name? It appears that based on the prevailing sentiment the answer is "NO". Of course this is hogwash. The question really is when will the next significant bear market occur? Since the 2009 bottom and especially since the 2011 low the ES/SPX has relentlessly ground higher with only minor hiccups along the way. And it could keep grinding higher for some time yet.

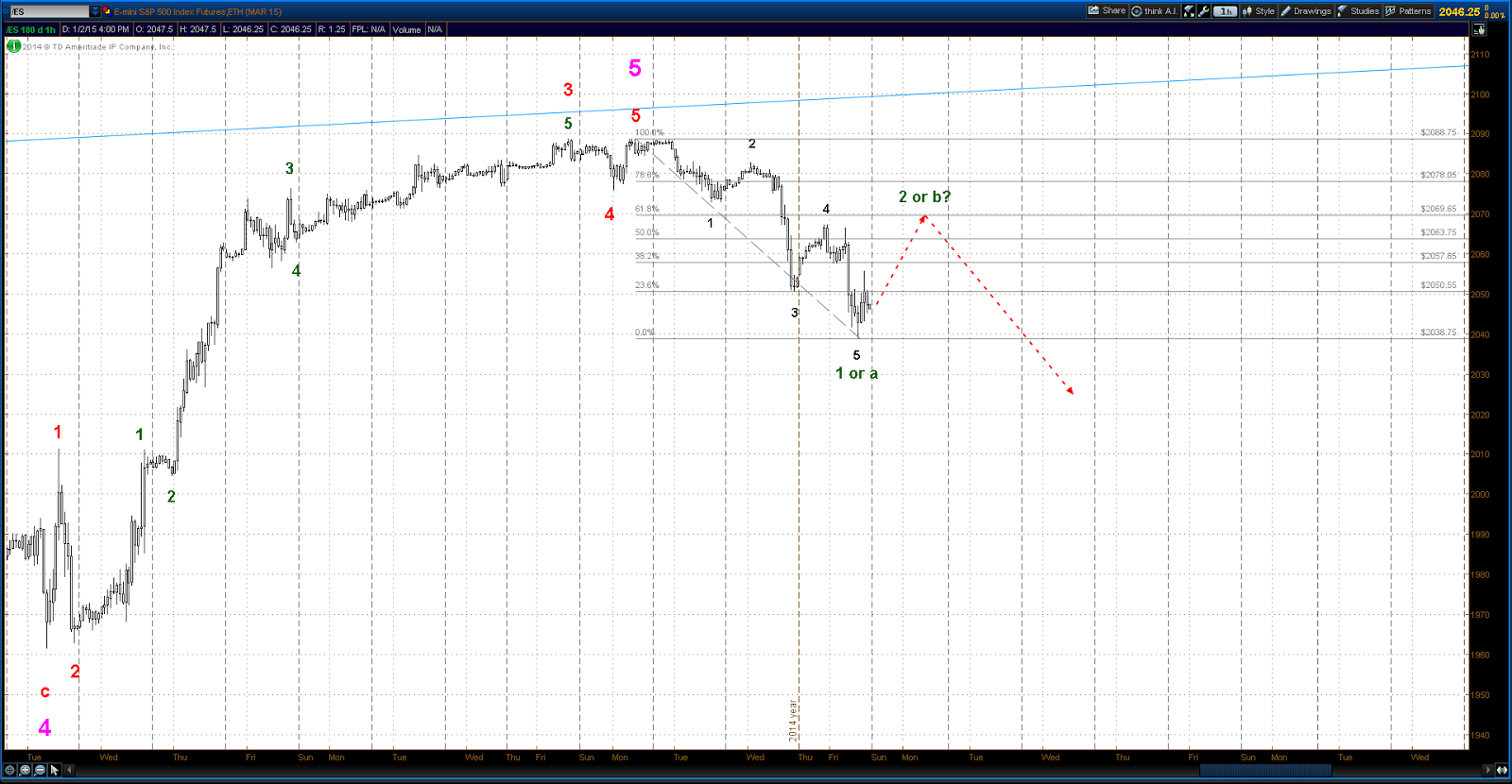

However, from an EW standpoint the very 1st condition to be met for a sustained bear to occur is now in place, and that is a clear 5 wave impulse down from a top. Since the 2088.75 high of Dec 29 the ES chart shows a classic looking 5 wave down structure into Friday's low at 2038.75. So for sure there should be more to come in this sell off following a corrective sequence of a day or two - in EW an initial 5 wave move in the direction opposite to the prior trend indicates the necessity for at least one more impulse in that opposite direction (unless the initial impulse was the C wave of a flat, which is not the case here). So there should be more selling showing up by the end of next week. If this is to turn into something more serious, there needs to be continued selling past a correction to the next selloff - i.e. a down impulse of larger degree needs to form. So stay tuned.

Sunday, January 4, 2015

blog comments powered by Disqus

Subscribe to:

Post Comments (Atom)