McClellan Oscillator is currently showing a divergence that looks quite similar to the pattern exhibited in mid-May:

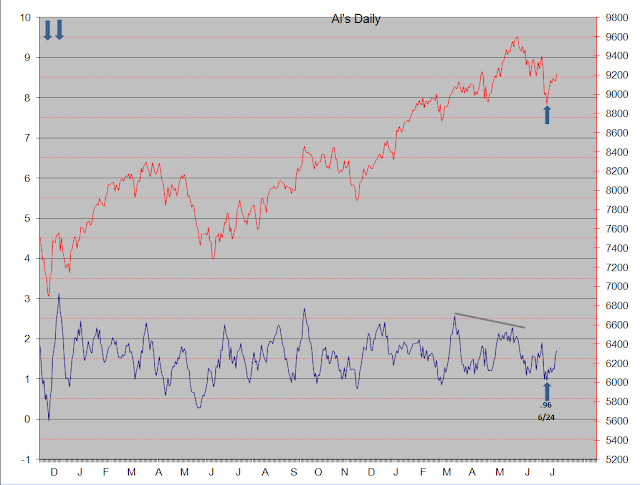

The Vindicator Buy/Sell index (a proprietary indicator that measures buying & selling pressure) shows a steady decline of buying pressure (green line) after an initial 1st wave burst off the June 24th low:

Sentiment as measured by the VIX is showing high levels of complacency:

And the current EW count shows the ES/SPX in the 5th of a 5th wave:

All of which is to say that the odds highly favor an intermediate term top near at hand.

AND if the long term bear alternate count is the correct one, then it will be a very significant long term top:

Saturday, July 27, 2013

Saturday, July 20, 2013

Saturday, 7/20/13 update

The bull continues to run, no surprise given all the bull---- being pumped out by the Fed. Although this bull is beginning to look a little winded. I would be too if I had chased down and stomped as many bears as he has. Word is that Prechter's crew has even turned short term bullish, certainly an ominous sign - when the last bear capitulates the top can't be far away (full disclosure - I used to be a big fan of EWI in the late '80's, lost A LOT of money when I let their perma-bear attitudes influence my thinking - yes, they have been perma-bears going that far back).

If the below Elliott count is accurate, then we should see some choppiness and volatility over the coming week or two. That should set up some technical divergences and lead into a fairly significant intermediate term (and possibly long term) top.

If the below Elliott count is accurate, then we should see some choppiness and volatility over the coming week or two. That should set up some technical divergences and lead into a fairly significant intermediate term (and possibly long term) top.

Saturday, July 13, 2013

Saturday, 7/13/13 update

This is beginning to look like a blow-off top in equities. The steepness of the ascent since the Jun 24 low is notable, and it's a fair guess that if the ES/SPX continues to steam upwards at this rate through the all time high at ES 1685.75 (only 16 points away as of Friday close) then it will possibly hit some major stop losses on short positions and actually accelerate. Current long term bull and bear alternates look like this:

Bull alternate

Bear alternate

In depth discussion of these alternates can be found in the chart section of this site here.

From a short term perspective, the rally from the Jun 24 low into the Jul 1 top looks like the 1st wave of the move. Wave 2 bottomed (after an odd looking correction) at 1594.00 on Jul 3rd and wave 3 is currently in progress. Best guess on the internal count for wave 3 is shown, which will require two wave 4 & 5 sequences yet to complete. However, it should be mentioned that there is a way to count wave 3 as much closer to completion (not shown). So the status of wave 3 is an open question. Either way, it appears that the bull move off the Jun 24 low has a distance yet to travel before a significant top can be expected.

One other note: the Al's travel indicator is about to go off. I'm scheduled for a 5 day business trip starting Sunday, Jul 21 through Thur, Jul 25. Because I'll be on the road in airplanes and driving etc I won't be able to monitor the market very closely at all. When I travel it seems that the ES inevitably hits a critical juncture and I miss a major turn (last trip I was on was Apr 16 - 19). So put your astrology charts aside, more than likely the current bull move will top somewhere in the Jul 21 to Jul 25 time frame based on my travel plans. And if that happens, I'm going to once again ask WHO'S IN CHARGE OF THIS S....!!

Sunday, July 7, 2013

Sunday, 7/7/13 update

I'm going to be famous. I've discovered a new type of corrective formation to add to the Elliott Wave list of zig-zag, flat and triangle. It happened early last week in the ES.

I stared and stared at my charts Thursday night trying to determine exactly what that formation is, and never reached a fully satisfying conclusion. Is it a flat? Possibly. Except the C leg isn't a clear 5. Is it a triangle? Definitely not. Is it a zig-zag? Possibly a triple zig-zag, but it's not very clean. So maybe it's something entirely new. I decided to name it a "WTF". Stands for "Wiggle Thy Finger" or "Whip The Fool" or something like that (this is a G rated site) - you get the idea.

Just kidding.

Turns out that the buy signal of Jun 25 on Al's Indicator may be a very good one after all. I viewed it with a fair amount of skepticism at the time. But since then the moves up have been impulsive and moves down have been corrective. So it looks like the IT correction from the May 22 top ended at the Jun 24 lows. If so, the current count on both the bullish and bearish alternates puts the ES/SPX in a 5th wave with a target in the low 1700's at a minimum.

It should be noted that the rally from the Jun 24 lows may be an "X' wave preceding a third and final zig-zag into new lows for Minor W4, but this possibility seems unlikely. It will definitely be ruled out if the ES trades above the Jun 19 "X" wave high of 1649.00.

I stared and stared at my charts Thursday night trying to determine exactly what that formation is, and never reached a fully satisfying conclusion. Is it a flat? Possibly. Except the C leg isn't a clear 5. Is it a triangle? Definitely not. Is it a zig-zag? Possibly a triple zig-zag, but it's not very clean. So maybe it's something entirely new. I decided to name it a "WTF". Stands for "Wiggle Thy Finger" or "Whip The Fool" or something like that (this is a G rated site) - you get the idea.

Just kidding.

Turns out that the buy signal of Jun 25 on Al's Indicator may be a very good one after all. I viewed it with a fair amount of skepticism at the time. But since then the moves up have been impulsive and moves down have been corrective. So it looks like the IT correction from the May 22 top ended at the Jun 24 lows. If so, the current count on both the bullish and bearish alternates puts the ES/SPX in a 5th wave with a target in the low 1700's at a minimum.

It should be noted that the rally from the Jun 24 lows may be an "X' wave preceding a third and final zig-zag into new lows for Minor W4, but this possibility seems unlikely. It will definitely be ruled out if the ES trades above the Jun 19 "X" wave high of 1649.00.

Subscribe to:

Comments (Atom)